For the 24 hours to 23:00 GMT, USD declined 0.27% against the CAD to close at 1.0020. Positive economic data in the US prompted investors to take out money from the safe haven greenback and invest in riskier currencies.

In the US, new orders of manufactured durable goods climbed 3.0% in December, from an upwardly revised increase of 4.3% in November. Separately, the Federal Reserve Bank of Chicago reported that the Chicago Fed National Activity Index advanced to 0.17 in December, from -0.46 in November.

In the Asian session, at GMT0400, the pair is trading at 1.0022, with the USD trading 0.03% higher from yesterday’s close.

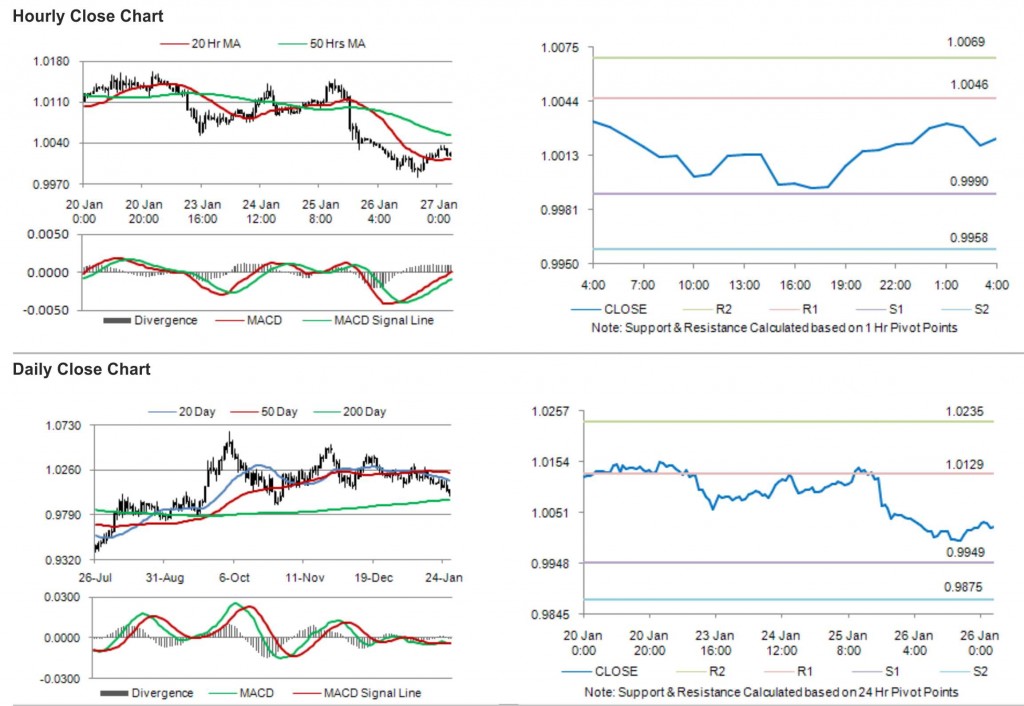

The pair is expected to find support at 0.9990, and a fall through could take it to the next support level of 0.9958. The pair is expected to find its first resistance at 1.0046, and a rise through could take it to the next resistance level of 1.0069.

The Canadian economic calendar being almost empty today, the CAD is expected to ride on other market cues.

The currency pair is trading between its 20 Hr and its 50 Hr moving averages.