For the 24 hours to 23:00 GMT, GBP fell 0.90% against the USD and closed at 1.6054.

BOE kept its benchmark interest rate at record low as policymakers decided to sideline concerns on increasing inflation pressures so as to support economic recovery in the UK.

In the UK, manufacturing production rose to 1.0% (M-o-M) in January from a decline of 0.1% in December, while industrial production rose by 0.5% (M-o-M) in January from 0.6% increase in December. The National Institute of Economic and Social Research reported that, on a sequential basis, the GDP in the UK rose 0.2% in the quarter ended in February.

The pair opened the Asian session at 1.6054, and is trading at 1.6072 at 4.00GMT. The pair is trading 0.11% higher from the New York session close.

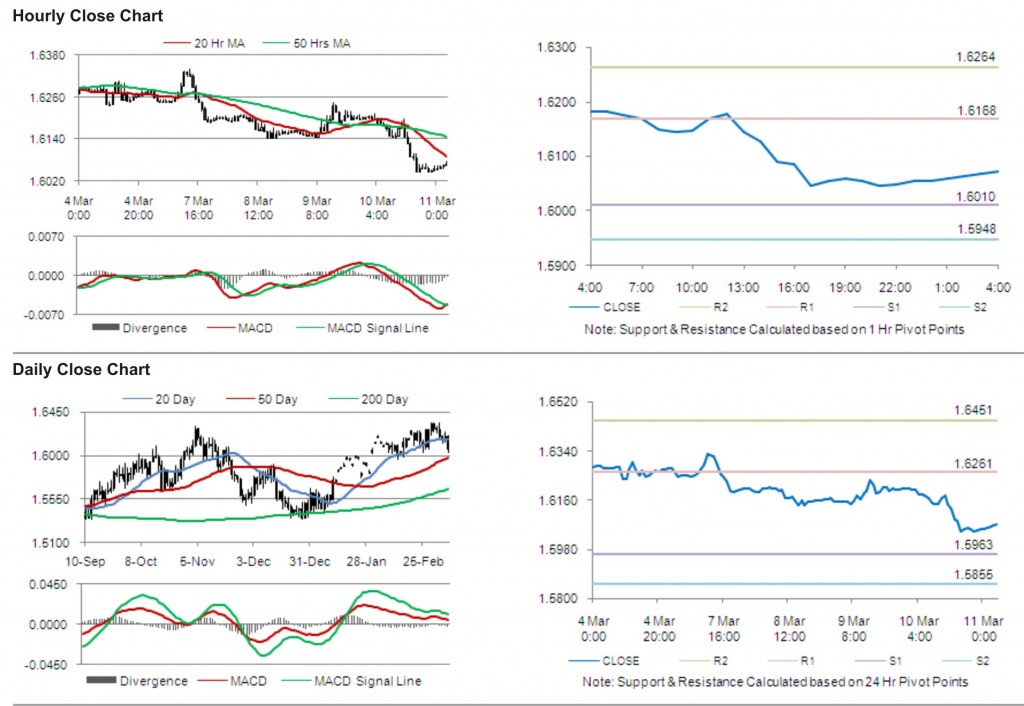

The pair has its first short term resistance at 1.6168, followed by the next resistance at 1.6264. The first support is at 1.6010, with the subsequent support at 1.5948.

BOE Governor King’s speech is likely to receive increased market attention, with other UK data due to be released later today.

The currency pair is trading just below its 20 Hr moving average and well below its 50 Hr moving average.