For the 24 hours to 23:00 GMT, EUR declined 0.78% against the USD and closed at 1.3795, after Moody’s Investors Service downgraded Spain’s sovereign debt rating by a notch to Aa2 with a negative outlook, citing that it was uncertain about the country’s ability to improve its finances.

The European Central Bank (ECB) in its monthly bulletin increased its projections for inflation. The ECB’s projection for inflation now stands at 2.0% to 2.6% for 2011 and 1.0% to 2.4% for 2012. Meanwhile, lower end for Euro-zone’s Gross Domestic Product growth has been revised upwards and now stands at 1.3% to 2.1% for 2011.

In Germany, trade surplus fell to €10.1 billion in January from €12.2 billion surplus in December.

In the Asian session, at 4:00GMT, the EURUSD is trading at 1.3823, 0.20% higher from the levels yesterday at 23:00GMT.

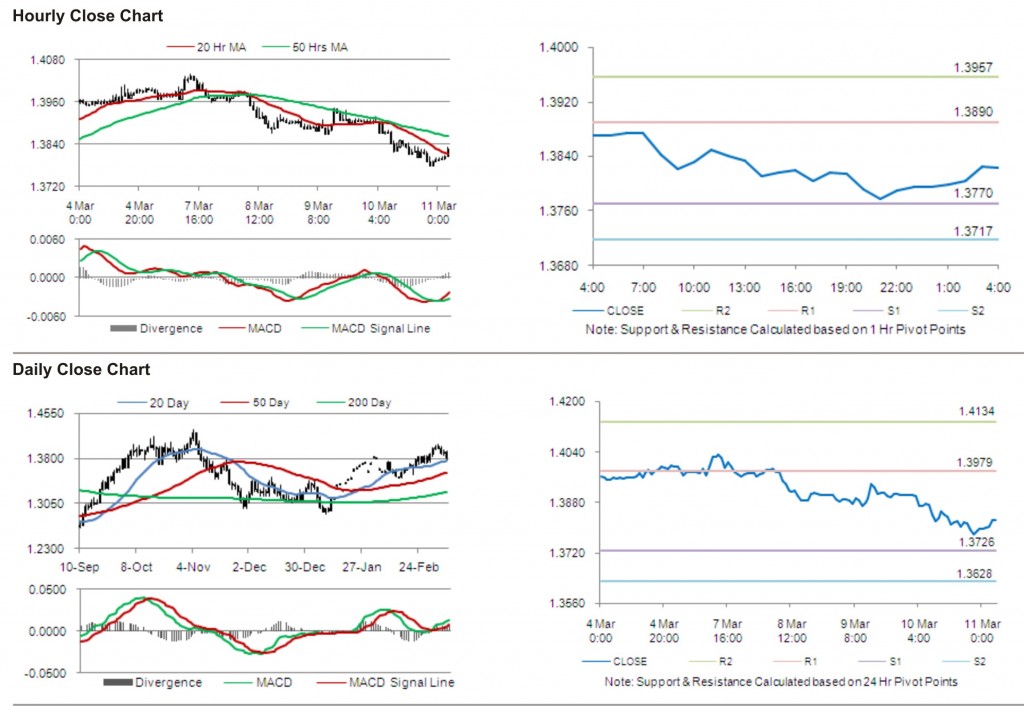

The pair has its first short term resistance at 1.3890, followed by the next resistance at 1.3957. The first support is at 1.3770, with the subsequent support at 1.3717.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.