For the 24 hours to 23:00 GMT, GBP rose 0.14% against the USD and closed at 1.6008.

The Bank of England (BoE) policy maker, Martin Weale stated that the UK inflation may rise more that the BoE forecast.

In the UK, the M4 money supply declined by 0.3% (M-o-M) in February, following a 0.8% rise posted in January. On a sequential basis, the gross domestic product (GDP) of the UK contracted 0.5% in the fourth quarter of 2010 (4Q FY2010), revised from a previously estimated decline of 0.6%. Additionally, the current account deficit in the UK widened to £10.5 billion in the fourth quarter of 2010 (4Q FY2010). Meanwhile, the consumer credit in the UK unexpectedly rose by £0.8 billion in February, following a £0.3 billion decline recorded in January.

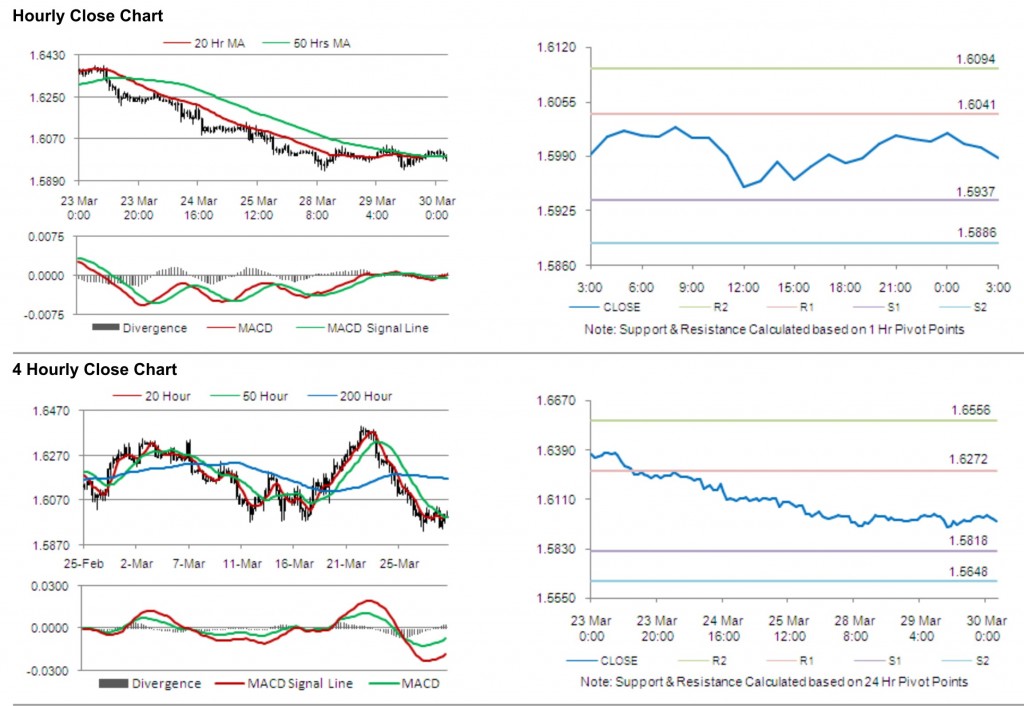

The pair opened the Asian session at 1.6008, and is trading at 1.5988 at 3.00GMT. The pair is trading 0.12% lower from the New York session close.

The pair has its first short term resistance at 1.6041, followed by the next resistance at 1.6094. The first support is at 1.5937, with the subsequent support at 1.5886.

Trading trends in the pair today are expected to be determined by data release on index of services and Gfk consumer confidence in the UK.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.