For the 24 hours to 23:00 GMT, USD strengthened 0.83% against the JPY and closed at 82.41, after St. Louis Federal Reserve President, James Bullard indicated that the US monetary authorities might have to start lay ground for gradual tightening if economy continues to recover at current levels.

In Japan, today morning, industrial production unexpectedly rose 0.4% (M-o-M) in February, following a 1.3% gain posted in January. Additionally, Shoko Chukin Bank reported that, the small business confidence rose to a reading of 49.5 in March, compared to a reading of 46.6 in February.

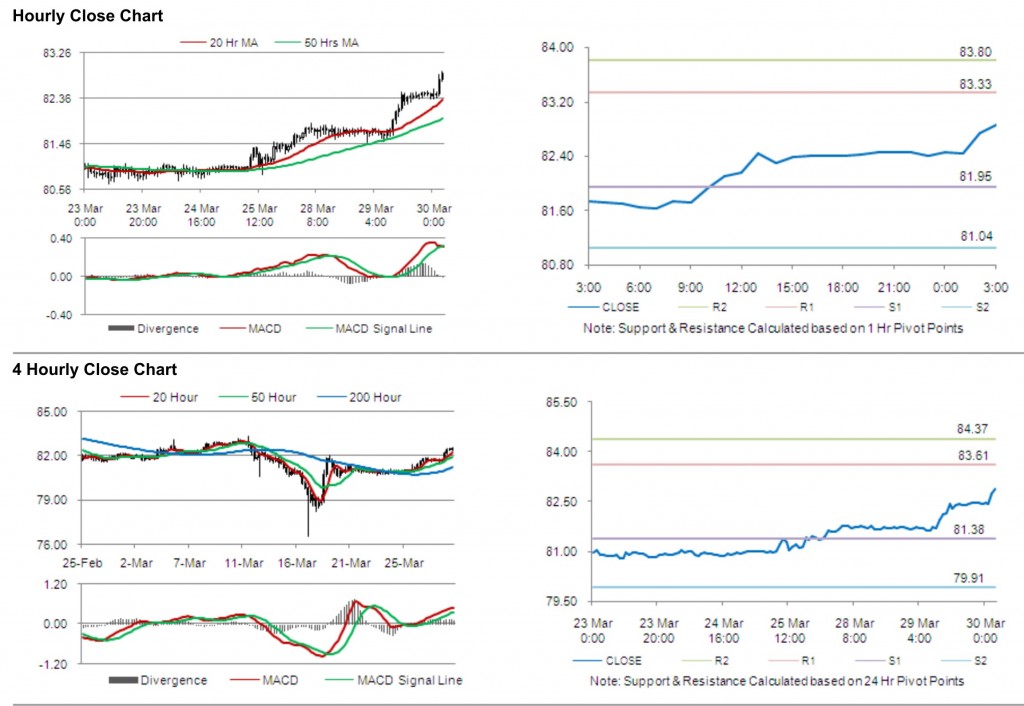

In the Asian session at 3:00GMT, the pair is trading higher from the New York close, by 0.55%, at 82.86.

The first short term resistance is at 83.33, followed by 83.80. The pair is expected to find support at 81.95 and the subsequent support level at 81.04.

Trading trends in the pair today are expected to be determined by data release on manufacturing purchasing manager index (PMI) and average cash earnings in Japan.

The currency pair is showing convergence with its 20 Hr moving average and its 50 Hr moving average.