For the 24 hours to 23:00 GMT, GBP fell 0.53% against the USD and closed at 1.6253, after a report showed the consumer prices in UK fell unexpectedly in March, dampening expectations over the interest rate hike by the Bank of England in the near term.

The trade deficit in the UK unexpectedly fell to £6.8 billion in February, compared to a revised deficit of £7.8 billion recorded in the previous month. The annual inflation in the UK fell to 4.0% in March, compared to a rate of 4.4% recorded in February. Additionally, the monthly Consumer Price Index (CPI) increased 0.3% in March, compared to a 0.7% rise recorded in the previous month. The annual retail price inflation in the UK fell to 5.3% in March, compared to a rate of 5.5% recorded in February. The Department of Communities and Local Government (DCLG) indicated that on an annual basis, the housing prices in the UK increased 0.7% in February, following a 0.5% rise recorded in the previous month.

The pair opened the Asian session at 1.6253, and is trading at 1.6254 at 3.00GMT. The pair is trading 0.01% higher from the New York session close.

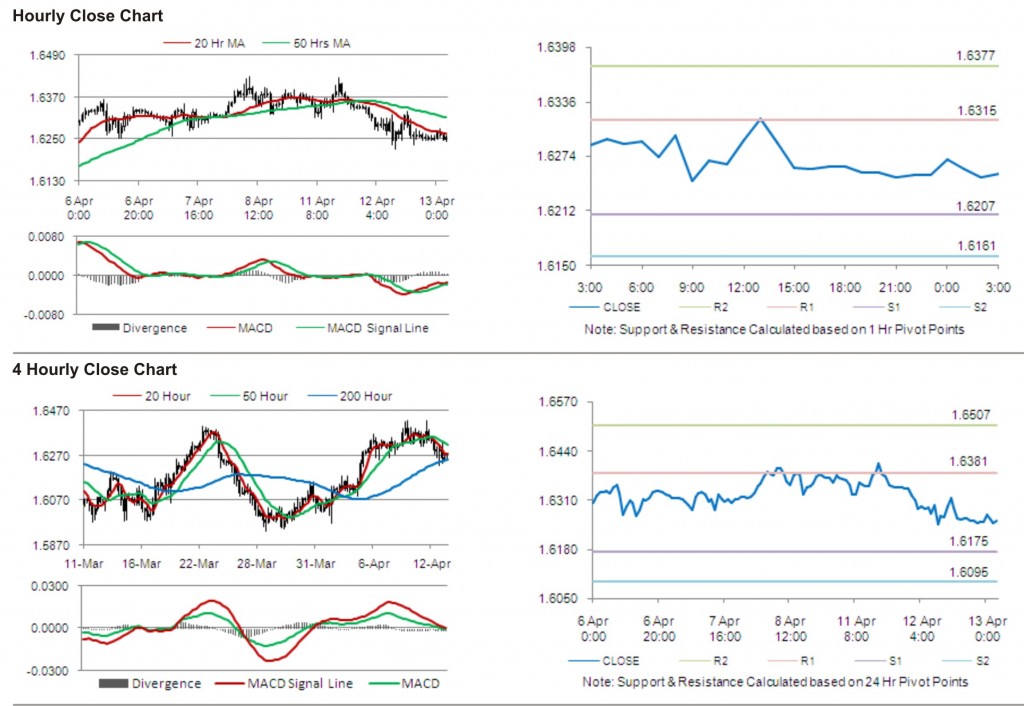

The pair has its first short term resistance at 1.6315, followed by the next resistance at 1.6377. The first support is at 1.6207, with the subsequent support at 1.6161.

With a series of UK economic releases today, including claimant count rate and ILO unemployment rate, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr moving average and is trading just below its 50 Hr moving average.