For the 24 hours to 23:00 GMT, EUR rose 0.30% against the USD and closed at 1.4473, surging to a fresh 15-month high, after data showed the US trade deficit shrank in February..

In the EU, the ZEW economic sentiment index in Germany fell to a reading of 7.6 in April, following a reading of 14.1 in March. Additionally, the current conditions index unexpectedly improved to a reading of 87.1 in April, compared to a reading of 85.4 posted in the previous month. The annualized consumer price inflation (CPI) in Germany stood at 2.1% in March, matching the previous estimate in the preliminary report. Meanwhile, the annualized harmonized inflation was revised upwards to 2.3% in March, compared to a previous estimate of 2.2%.

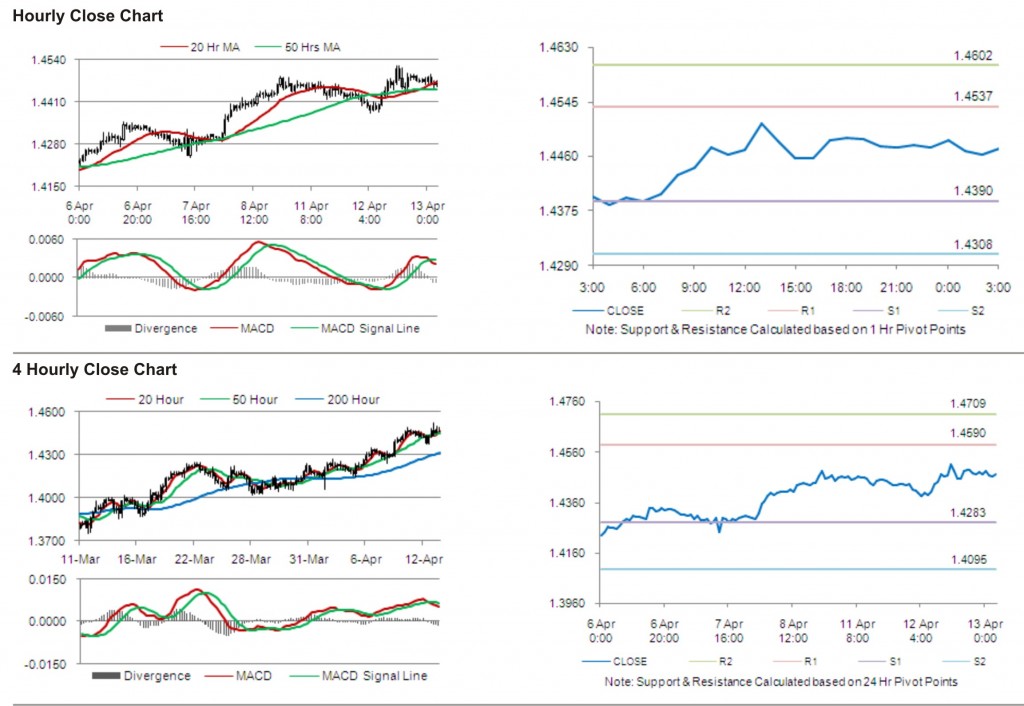

In the Asian session, at 3:00GMT, the EURUSD is trading at 1.4471, 0.01% lower from the levels yesterday at 23:00GMT.

The pair has its first short term resistance at 1.4537, followed by the next resistance at 1.4602. The first support is at 1.4390, with the subsequent support at 1.4308.

Trading trends in the pair today are expected to be determined by data release on Wholesale Price Index and industrial production in the Euro Zone.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.