For the 24 hours to 23:00 GMT, AUD weakened 0.71% against the USD to close at 1.0485.

In Australia, minutes of the April meeting of the Reserve Bank of Australia’s monetary policy committee showed that members considered 4.75% key cash rate appropriate to ensure the medium-term inflation outlook to be consistent with the target.

LME Copper prices declined 0.7% or $63.5/MT to $9,356.5/ MT. Aluminium prices rose 0.8% or $21.0/MT to $2,659.0/ MT.

In the Asian session at 3:00GMT, the pair is trading at 1.0471, 0.13% lower from the New York session close, after Standard & Poor’s cut the US long-term credit outlook to negative, thus damping the demand for higher-yielding assets.

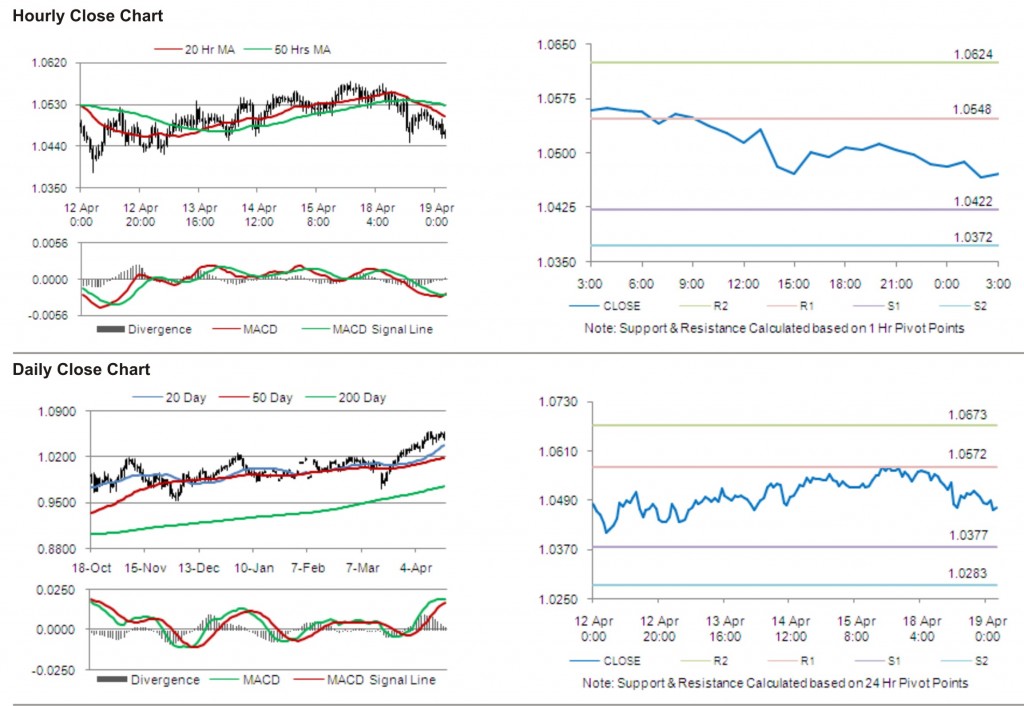

The pair is expected to find first short term resistance at 1.0548, with the next resistance levels at 1.0624 and 1.0750, subsequently. The first support for the pair is seen at 1.0422, followed by next supports at 1.0372 and 1.0246 respectively.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.