For the 24 hours to 23:00 GMT, USD rose 0.47% against the CAD to close at 0.9643. The Canadian dollar softened against the greenback yesterday in a flight to safety as a squall of uncertainty, including Standard & Poor’s long-term downgrade of the United States, hit investor sentiment. Loonie was also battered by lower oil prices and concerns over euro debt and the possibility of a slowdown in the Chinese economy.

In Canada, non-resident investors sold $1.6 billion of Canadian bonds in February, the first divestment since December 2008. The non-resident acquisitions of Canadian securities slowed to C$2.5 billion in February. Meanwhile, Canadian investment in foreign securities rose to C$2.6 billion in February.

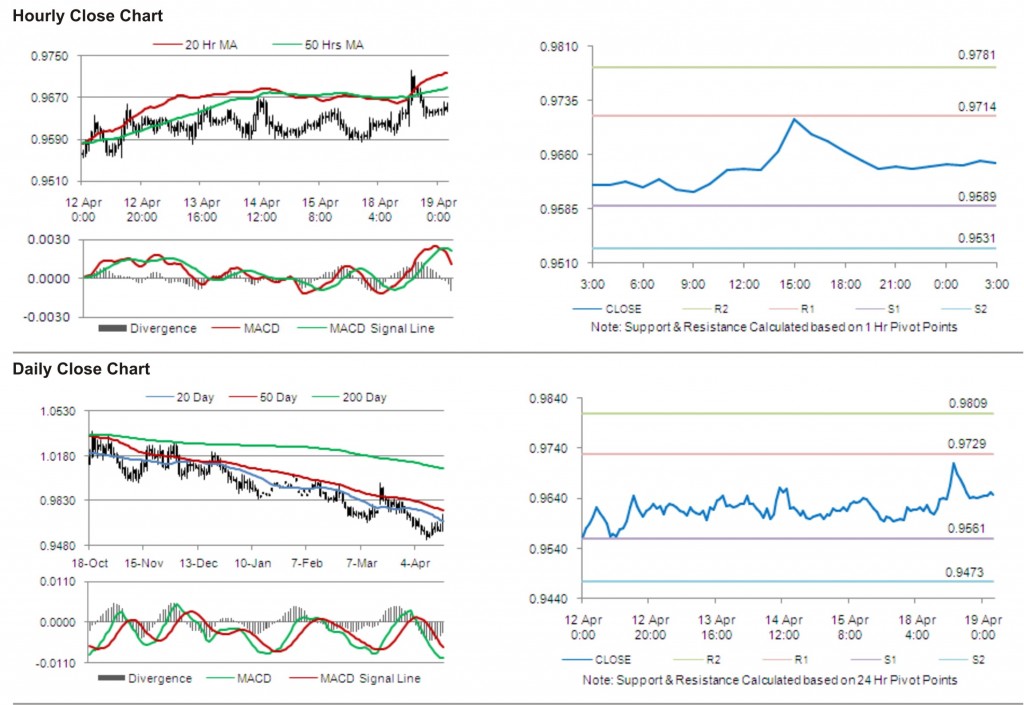

In the Asian session at 3:00GMT, the pair is trading at 0.9648, 0.05% higher from the New York session close.

The first area of short term resistance is observed at 0.9714, followed by 0.9781 and 0.9906. The first area of support is at 0.9589, with the subsequent supports at 0.9531 and 0.9406.

Trading trends in the pair today are expected to be determined by release of data on consumer price index and wholesale sales in Canada.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.