For the 24 hours to 23:00 GMT, USD declined 0.92% against the CHF and closed at 0.8651, after Philipp Hildebrand, President of Swiss National Bank, stated that price stability may be threatened by higher commodity prices and expansionary monetary policy.

Additionally, KOF’s leading economic indicator in Switzerland unexpectedly rose to 2.29, from a revised reading of 2.25 in March, indicating that the economy is gaining momentum.

In the Asian session, at 3:00GMT, the pair is trading at 0.8687, 0.42% higher from the New York session close.

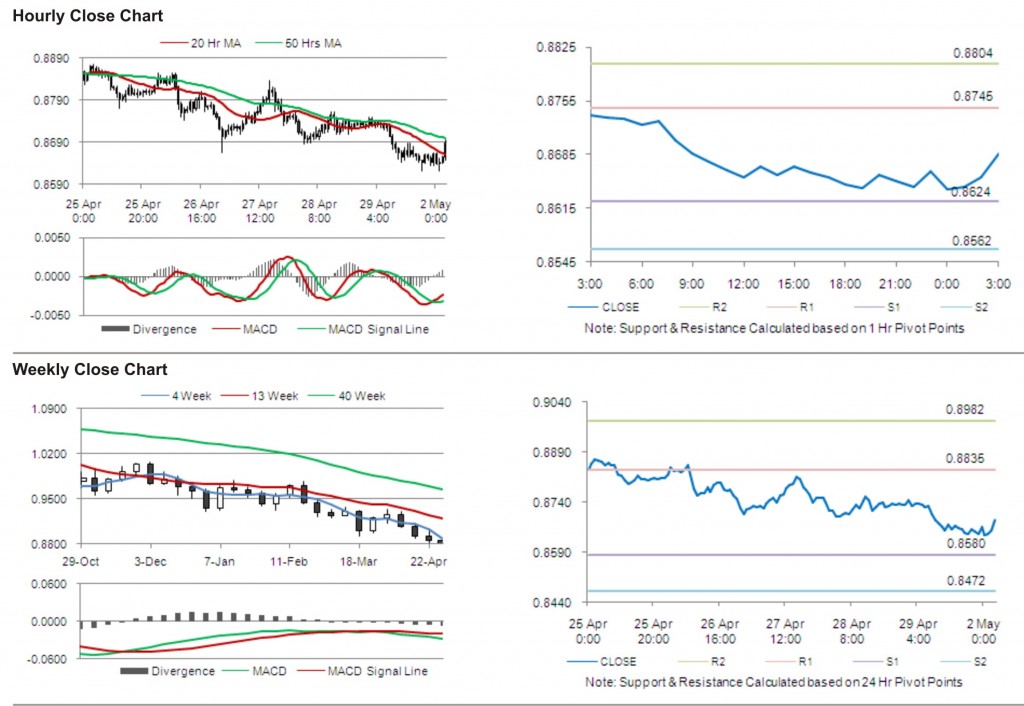

The pair has its first short term resistance at 0.8745, followed by the next resistance at 0.8804. The first area of support is at 0.8624 levels, with the subsequent support at 0.8562.

Trading trends in the pair today are expected to be determined by data release on retail sales and purchasing manager index in Switzerland.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.