For the 24 hours to 23:00 GMT, USD weakened 0.44% against the JPY and closed at 81.22. The Japanese Yen appreciated against the greenback on Friday, as speculation for a currency intervention resurfaced. Japan’s Ministry of Finance stated that the government did not sell the local currency between March 30 and April 26 despite the recent appreciation in the Yen, but the Group of Seven may take additional steps to aid the ailing economy as the Bank of Japan curbs its assessment for the real economy.

Federal Reserve Chairman, Ben Bernanke stated that the US economy is not fully recovered from its deep recession, with housing still weighing on growth.

In the Asian session at 3:00GMT, the pair is trading higher from the New York close, by 0.43%, at 81.57.

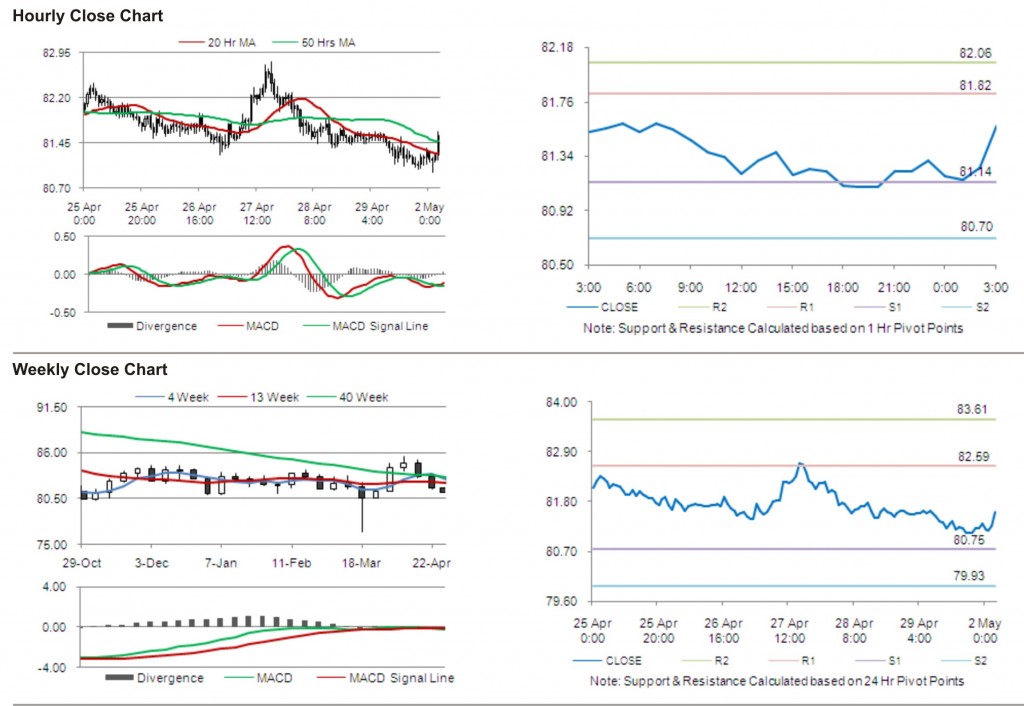

The first short term resistance is at 81.82, followed by 82.06. The pair is expected to find support at 81.14 and the subsequent support level at 80.70.

Trading trends in the pair today are expected to be determined by data release on labor cash earnings and vehicle sales in Japan.

The pair is trading just above its 20 Hr moving average and its 50 Hr moving average.