For the 24 hours to 23:00 GMT, GBP rose 0.41% against the USD and closed at 1.6632. However, the gains in the UK Pound were capped after the Bank of England (BoE) policy-maker, Paul Fisher, hinted that the central bank is not close to raising its interest rates despite the recent sharp fall in the nation’s unemployment rate. Adding to the negative sentiment was a report from the Confederation of British Industry (CBI), which showed that the distributive trades survey in the nation declined more-than-expected to a reading of 14.0 in January, from a level of 34.0 registered in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.6636, with the GBP trading marginally higher from yesterday’s close.

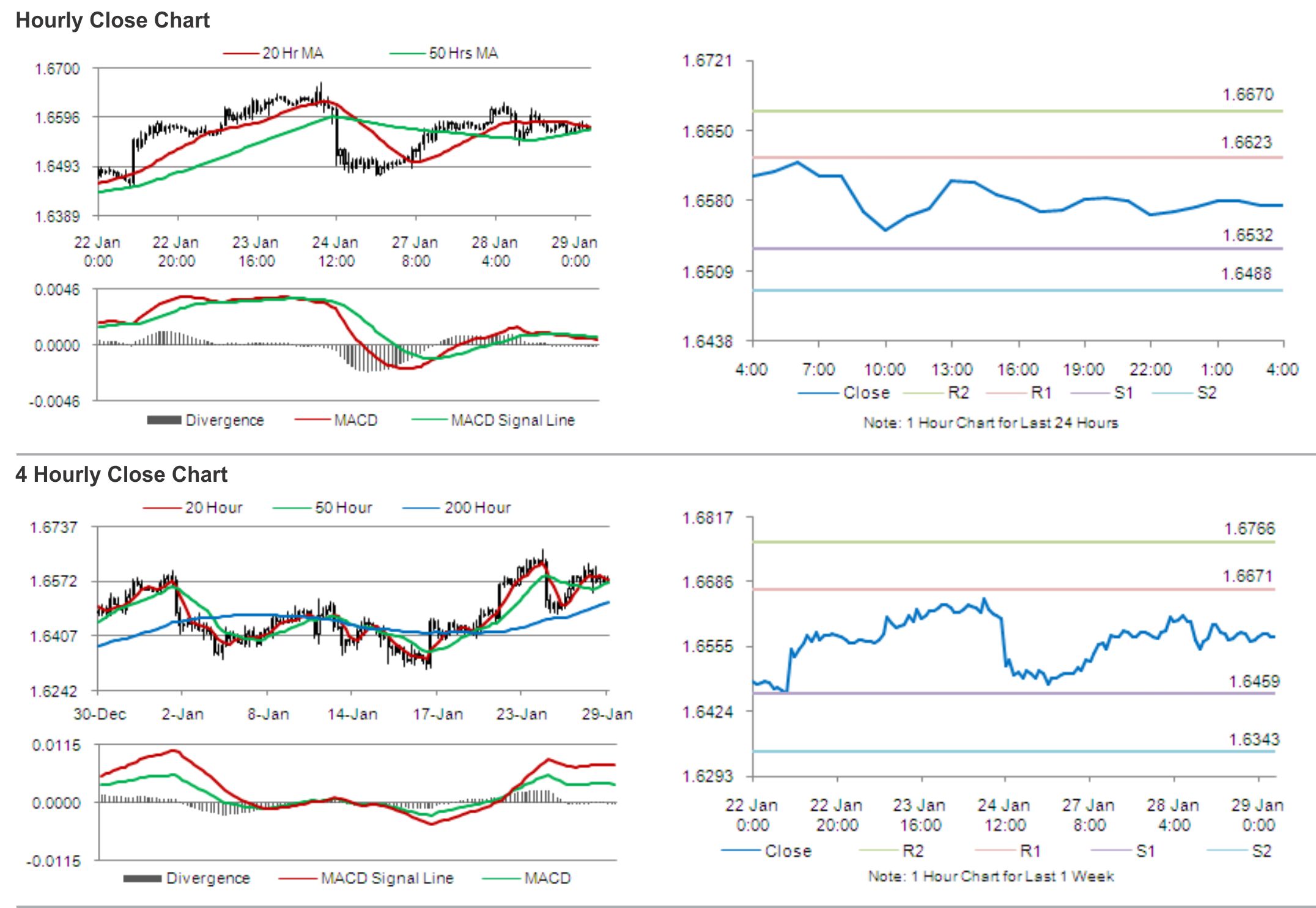

The pair is expected to find support at 1.6581, and a fall through could take it to the next support level of 1.6526. The pair is expected to find its first resistance at 1.6668, and a rise through could take it to the next resistance level of 1.6700.

Market participants would now keenly eye BoE Governor, Mark Carney’s speech, expected to commence later today, after he signalled that there is “no immediate need to increase interest rates” at the World Economic Forum in Davos. Also later today, the British Bankers’ Association (BBA) is scheduled to publish a report on the UK’s mortgage approvals for December.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.