For the 24 hours to 23:00 GMT, the USD weakened 1.21% against the JPY and closed at 103.39, after data revealed an increase in the US jobless claims for last week and after a report showed that activities in the US manufacturing sector slowed down in January.

Meanwhile, in Japan, the Bank of Japan (BoJ), in its monthly economic survey, affirmed that the nation’s economy is recovering at a moderate pace and that higher consumption has been noticed ahead of the government’s planned sales tax hike in April. Separately, the International Monetary Fund (IMF) Deputy Managing Director, Naoyuki Shinohara, stated that the Japanese economy is progressing toward achieving the BoJ’s 2% inflation target, but at the same time he also projected the economy to take more than two years to completely achieve the central bank’s inflation goal.

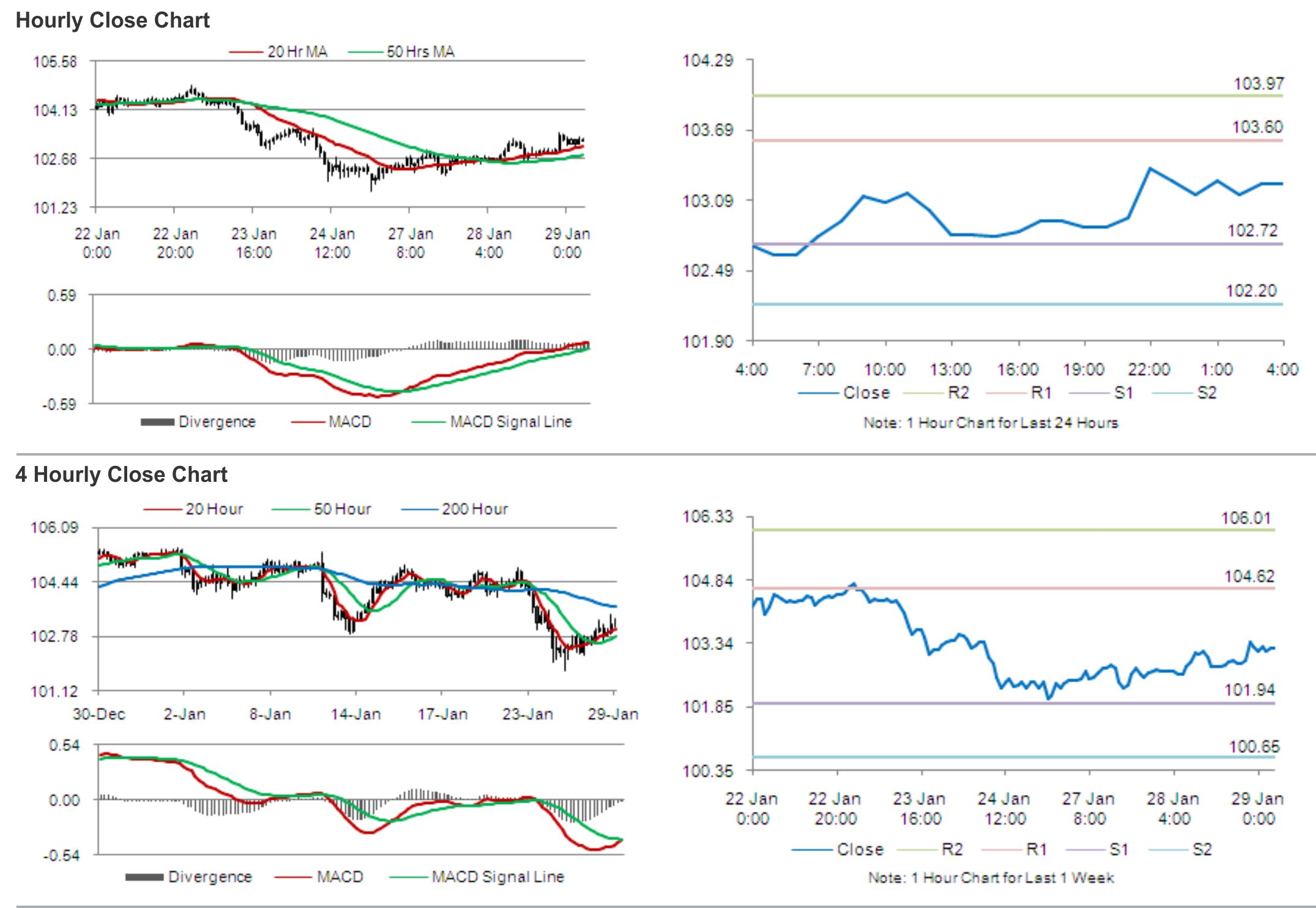

In the Asian session, at GMT0400, the pair is trading at 103.24, with the USD trading 0.14% lower from yesterday’s close.

The pair is expected to find support at 102.64, and a fall through could take it to the next support level of 102.03. The pair is expected to find its first resistance at 104.17, and a rise through could take it to the next resistance level of 105.10.

With no major economic releases in Japan in the weekend, yen traders would focus on the outcome of BoJ’s minutes of its latest monetary policy meeting on Monday.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.