For the 24 hours to 23:00 GMT, the USD declined 1.53% against the CHF and closed at 0.8982, hurt by a dismal US employment and manufacturing data.

Meanwhile, the Swiss Franc advanced against its US counterpart, after the Swiss government raised the capital requirements for banks to 2% from 1% of the risk-weighted assets in their mortgage portfolio, citing concerns over property boom.

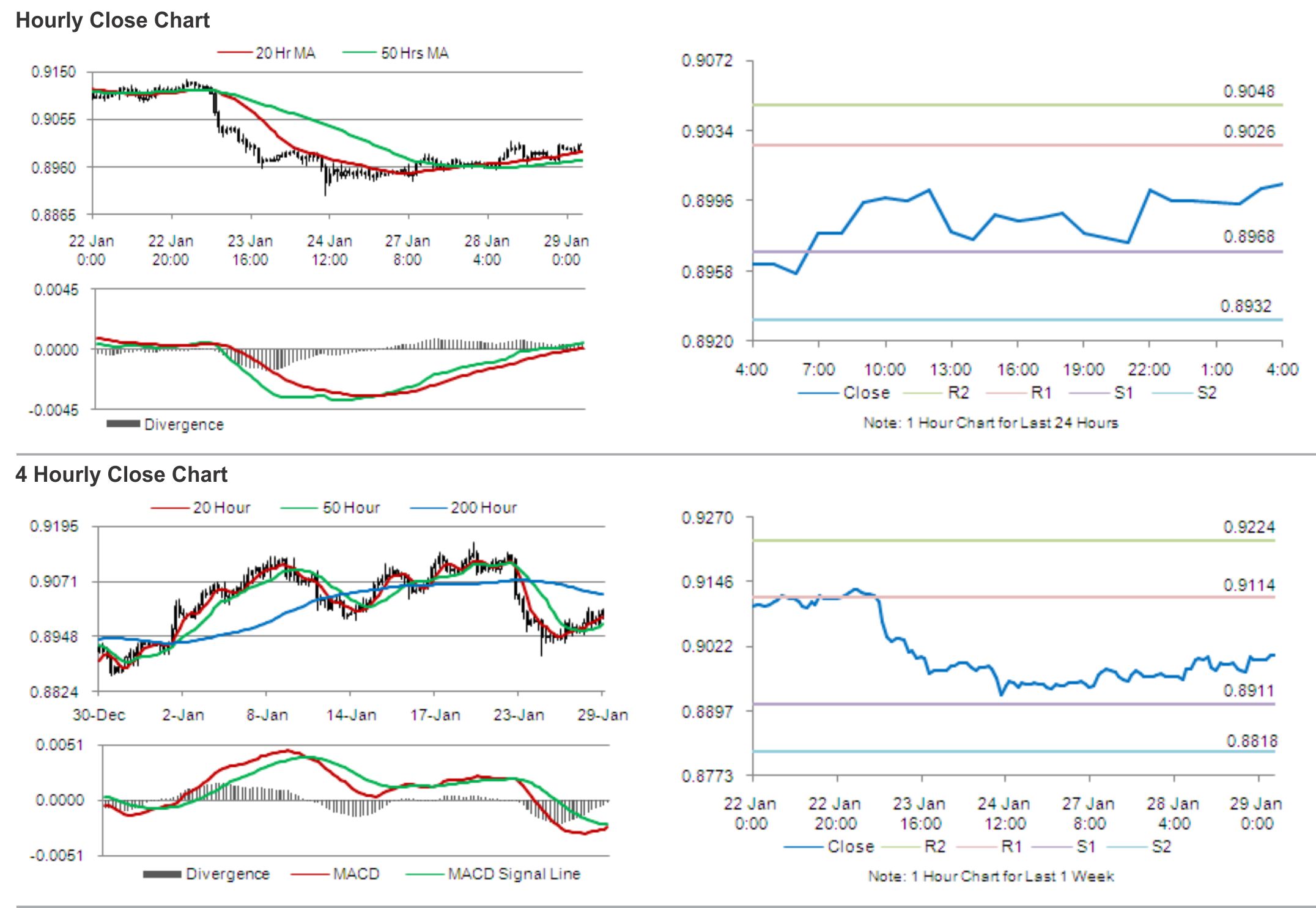

In the Asian session, at GMT0400, the pair is trading at 0.8980, with the USD trading marginally lower from yesterday’s close.

The pair is expected to find support at 0.8917, and a fall through could take it to the next support level of 0.8853. The pair is expected to find its first resistance at 0.9084, and a rise through could take it to the next resistance level of 0.9187.

Traders would keenly keep a tab on global economic news for further guidance in the pair, amid a lack of economic releases from Switzerland.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.