On Friday, GBP fell 0.80% against the USD and closed at 1.6499, after the Bank of England (BoE) Governor, Mark Carney indicated that despite the UK unemployment rate nearing the BoE’s 7% target, the central bank is in no hurry to raise its key interest rates. Furthermore, he downplayed the link established by the central bank between the unemployment rate and the BOE policy, and stressed that the central bank would take into account other factors as well to gauge the right interest-rate policy for the British economy, and would refrain from giving importance to just one indicator.

In economic news, the British Banker’s Association (BBA) indicated that the UK mortgage approvals came in below expectations, however it increased to a level of six-year high in December. The number of approved mortgages in the UK increased to a level of 46,521 in December, compared to a level of 45,394 reported in the previous month. Market had expected the UK mortgage approvals to rise 47,300 in December.

In the Asian session, at GMT0400, the pair is trading at 1.6500 with the GBP trading marginally higher from yesterday’s close.

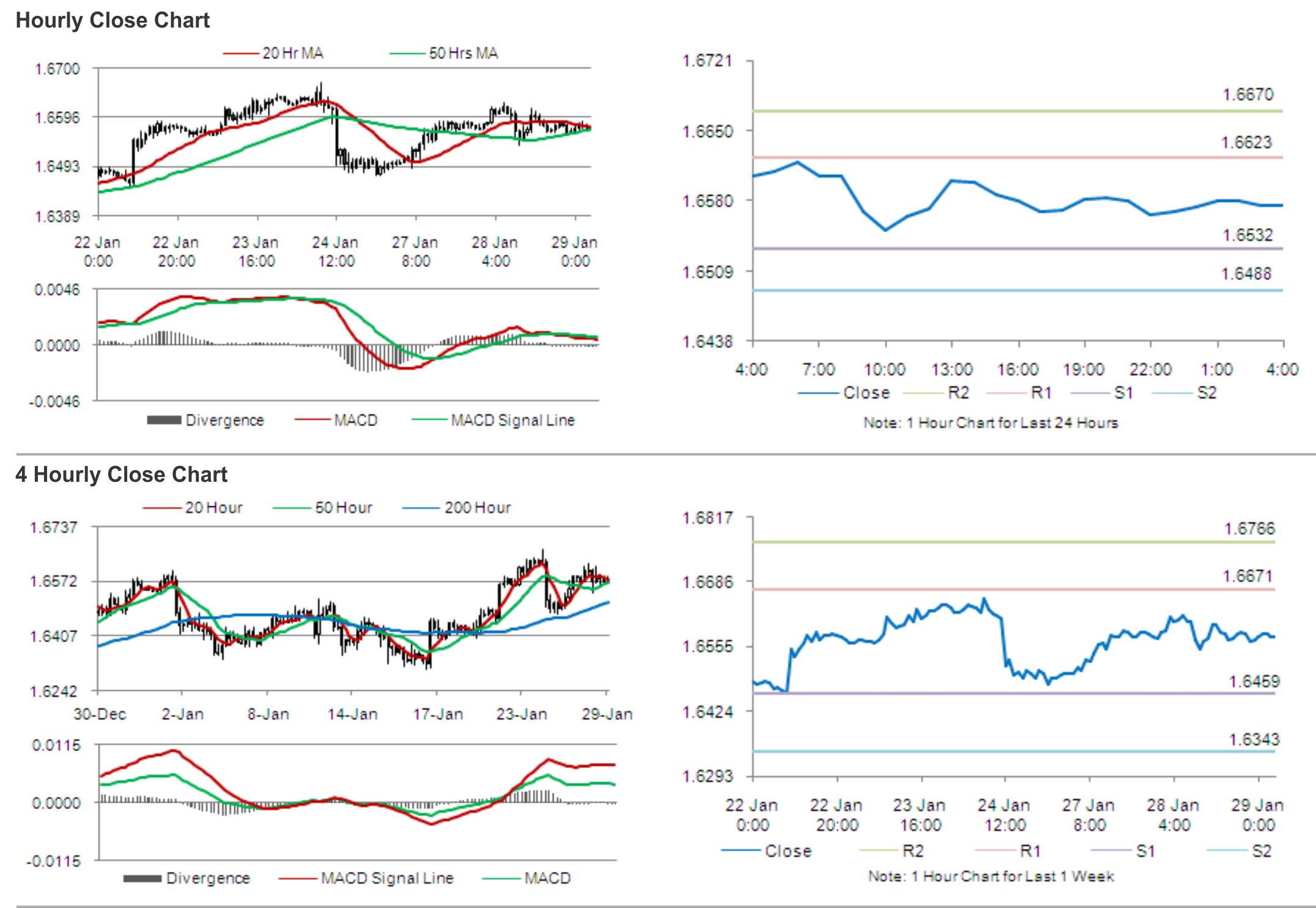

The pair is expected to find support at 1.6426, and a fall through could take it to the next support level of 1.6352. The pair is expected to find its first resistance at 1.6622, and a rise through could take it to the next resistance level of 1.6744.

During the week, investors would turn their attention on the UK Q4 GDP data, slated to release tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.