On Friday, the USD weakened 0.93% against the JPY and closed at 102.43.

In the Asian session, at GMT0400, the pair is trading at 102.40, with the USD trading marginally lower from yesterday’s close.

Today morning, the Bank of Japan (BoJ), revealed in its minutes of the monetary policy meeting held on 19-20 December 2013, that the policymakers believe that there is no immediate need for the central bank to further ease policy, citing that the effects of the BoJ’s ultra-loose monetary policy have increased steadily and that economic recovery in Japan is expected to continue at a moderate pace.

Separately, the Ministry of Finance reported that the total merchandise trade deficit in Japan widened to ¥1302.1 billion in December, compared to a revised ¥1294.1 billion deficit recorded in November. Markets were expecting the total merchandise trade deficit to narrow to ¥1239.9 billion in December.

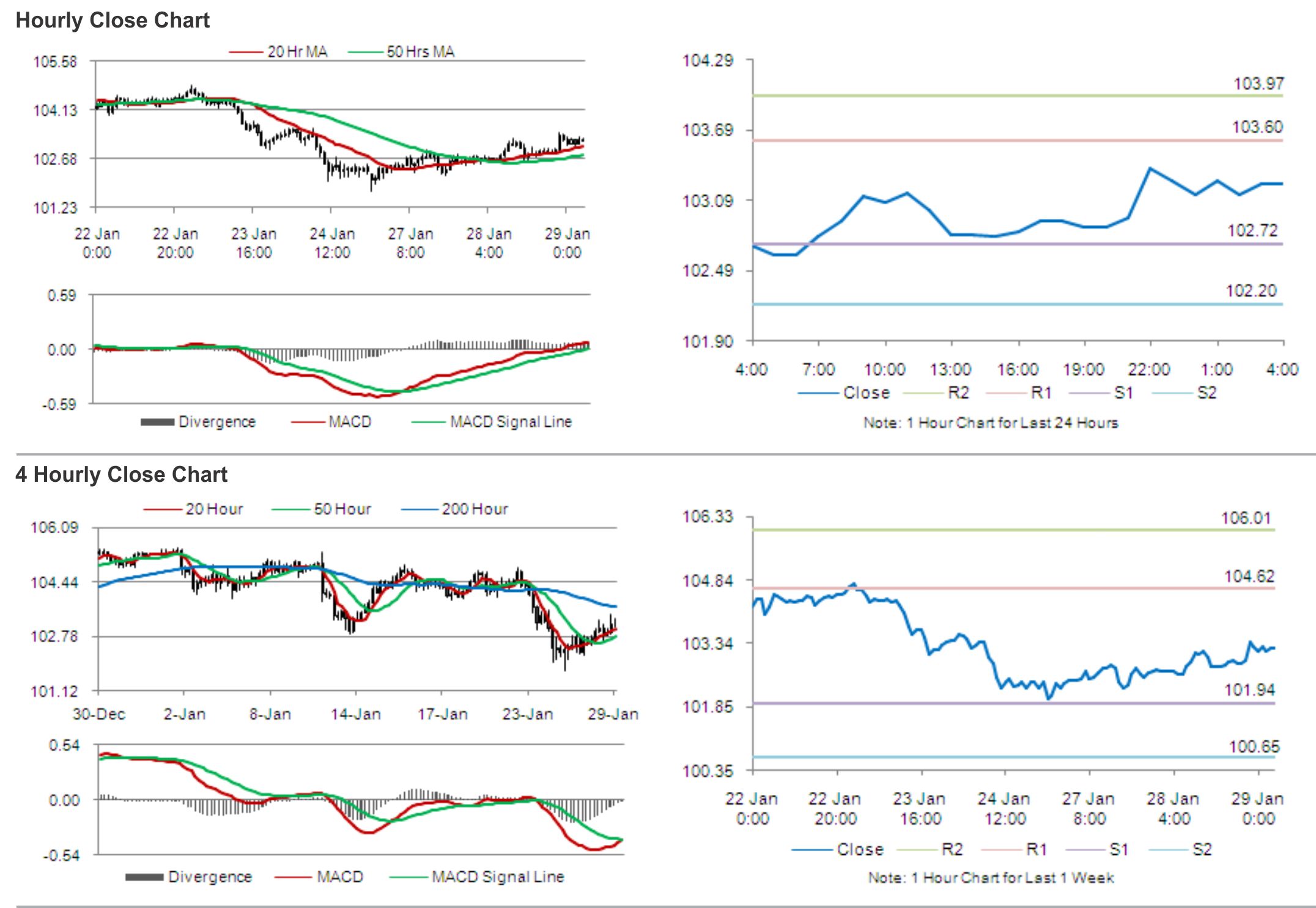

The pair is expected to find support at 101.56, and a fall through could take it to the next support level of 100.73. The pair is expected to find its first resistance at 103.40, and a rise through could take it to the next resistance level of 104.41.

Amid a lack of Japanese economic releases today, trading trends in the pair would likely be determined by the services PMI data from the US along with the new homes sales data and the Dallas Fed manufacturing business index, which are to be released later in the day.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.