For the 24 hours to 23:00 GMT, GBP fell 0.37% against the USD and closed at 1.6497.

Economic data released yesterday showed that mortgage approvals in the UK rose to 71,638 in December from an upwardly revised 70,820 in November. Market expected mortgage approvals to climb to 72,900. Additionally, consumer credit in the UK dropped to £0.6 billion in December, from £0.7 billion in the previous month.

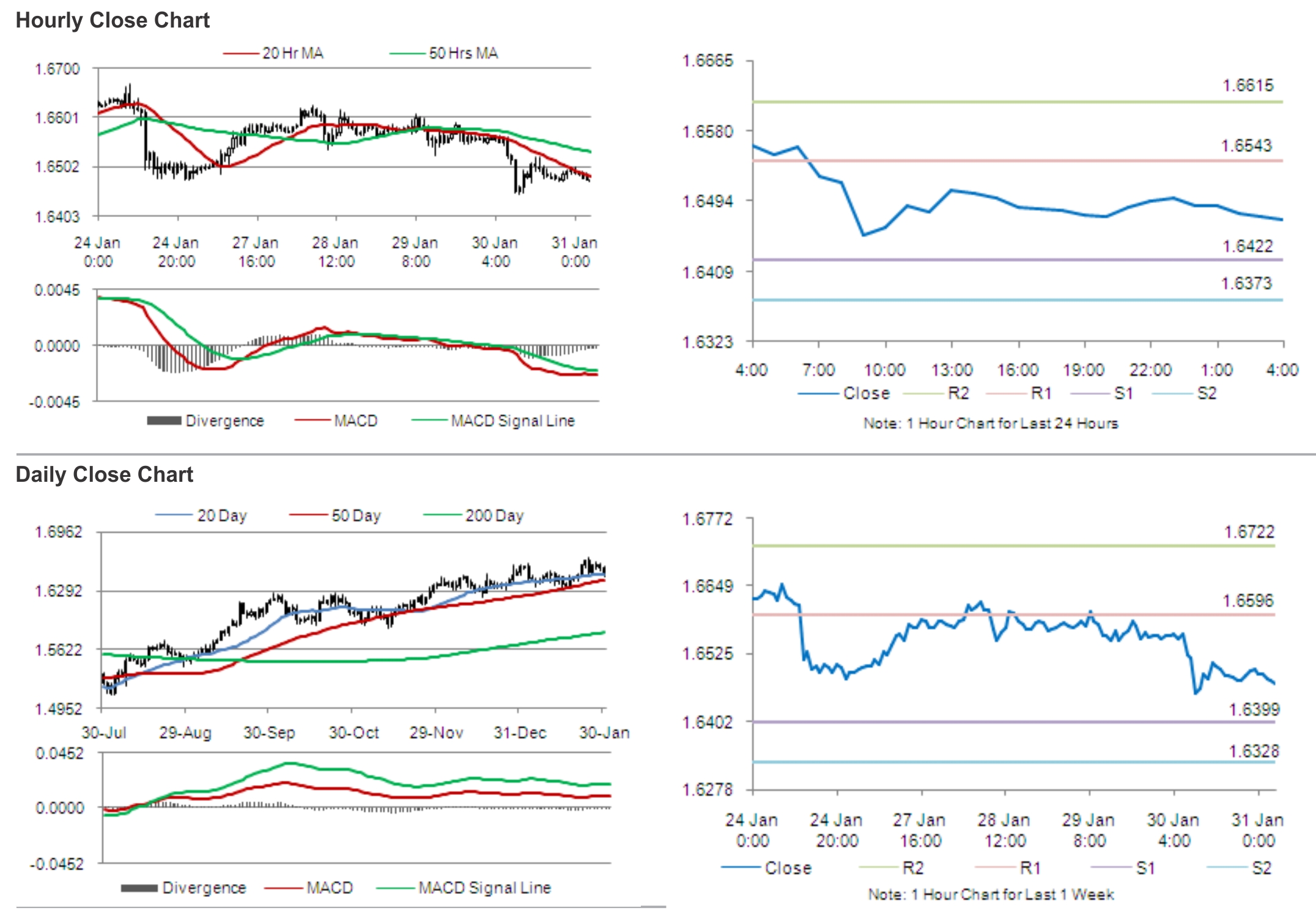

In the Asian session, at GMT0400, the pair is trading at 1.6471, with the GBP trading 0.16% lower from yesterday’s close.

In the UK, the Gfk consumer confidence index rose to a reading of -7.0 in December, compared to a reading of -13.0 in the previous month. Market expected the index to rise to a reading of -12.0.

Traders would now await next week’s Bank of England rate decision. Manufacturing, housing and trade balanced data would also grab attention.

The pair is expected to find support at 1.6422, and a fall through could take it to the next support level of 1.6373. The pair is expected to find its first resistance at 1.6543, and a rise through could take it to the next resistance level of 1.6615.

The currency pair is showing convergence with its 20 Hr and is trading below its 50 Hr moving average.