For the 24 hours to 23:00 GMT, EUR declined 0.72% against the USD and closed at 1.3558 The US Dollar continued to gain support, after the US economy grew in the fourth quarter. The Commerce Department’s Bureau of Economic Analysis (BEA) reported that the preliminary estimate of the gross domestic product (GDP) in the US rose at an annual rate of 3.2% in the Q4 2013, in line with market expectations but slower as compared to rise of 4.1% recorded in the preceding quarter. Additionally, the US gross domestic purchase price index increased 1.3% in Q4, in line with market expectations, and after rising 2.0% in Q3. Moreover, the personal consumption rose 3.3% (QoQ) in the fourth quarter, following a 2.0% gain reported in Q3.

However, initial jobless claims increased by 19,000 more than market forecasts to a seasonally adjusted 348,000 in the week ended January 25, following a revised 329,000 claims recorded in the last week. The National Association of Realtors reported that the US pending home sales index fell 8.7% on a seasonally adjusted monthly basis to a reading of 92.4 in December compared to a revised 0.3% decline recorded in November. Market had expected the pending home sales to drop 0.3% in December.

In Europe, unemployment rate in Germany remained steady at 6.8% in January. Markets were expecting the unemployment rate to rise to 6.9% in January. Meanwhile, the number of people unemployed in Germany fell by 28.0K in January, compared to a revised drop of 19.0K reported in the previous month and more than market expectations. On a monthly basis, German monthly preliminary CPI dropped 0.6% in January, after recording a rise of 0.4% in December. Meanwhile, economic sentiment indicator in the Eurozone rose in January. Separately, gross domestic product in Spain fell 0.1% (YoY) in the fourth quarter of 2013, compared to a 1.2% drop in the previous quarter.

In the Asian session, at GMT0400, the pair is trading at 1.3546, with the EUR trading 0.09% lower from yesterday’s close.

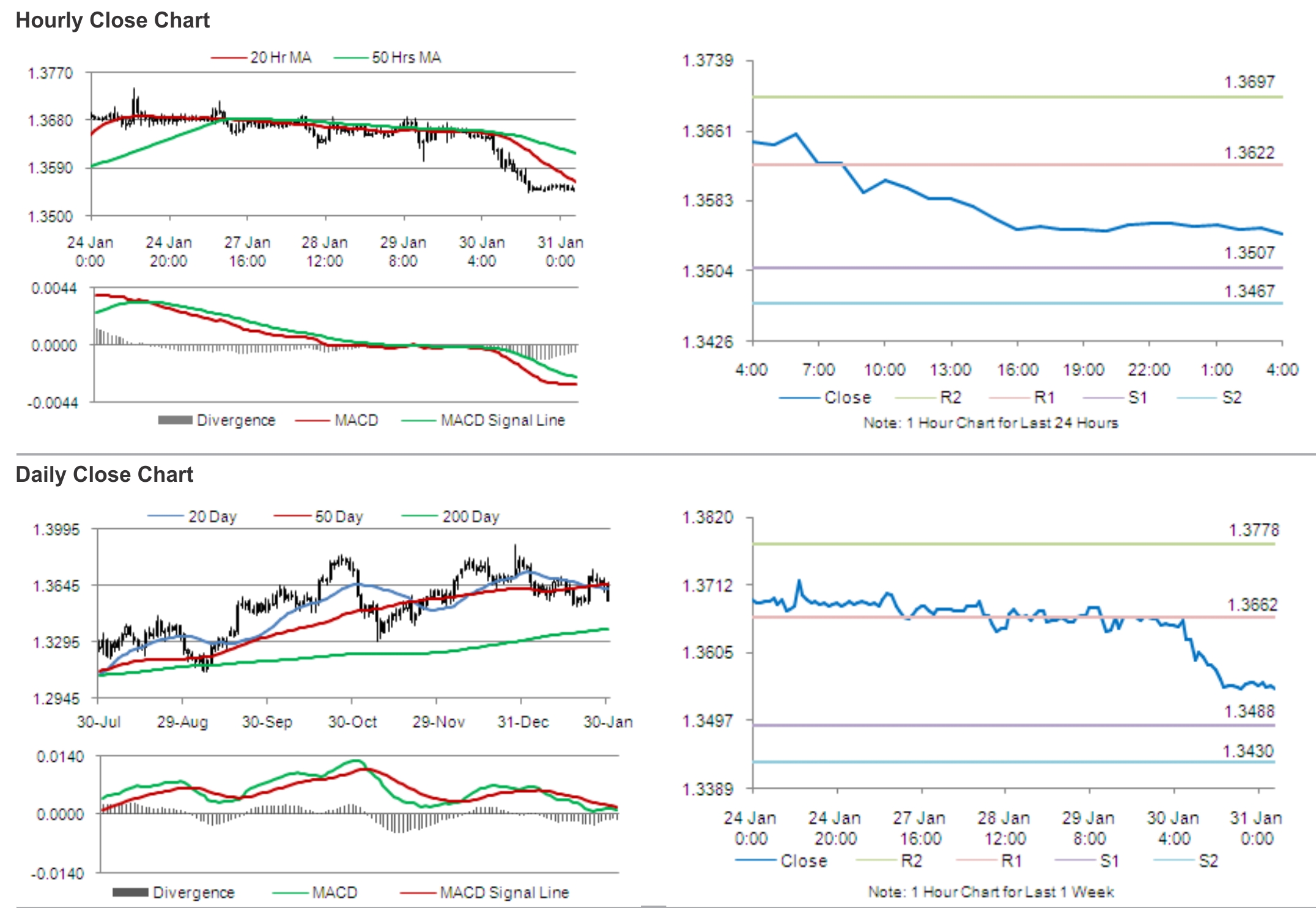

The pair is expected to find support at 1.3507, and a fall through could take it to the next support level of 1.3467. The pair is expected to find its first resistance at 1.3622, and a rise through could take it to the next resistance level of 1.3697.

The common currency is expected to take cues from the Eurozone economic releases scheduled today such as consumer prices, unemployment rate and retail sales data.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.