For the 24 hours to 23:00 GMT, USD rose 0.55% against the CAD to close at 0.9513. Political uncertainty weighed on the Canadian dollar on Monday, as Canadians headed to the polls for the fourth national election in seven years. Lower commodity prices and lower equity markets also weighed on Loonie.

In Canada, the industrial product price index, on monthly basis, rose by 0.9% in March following a 0.7% increase recorded in the previous month. Additionally, the raw material price index grew to 5.7% in March compared to 1.8% in previous month.

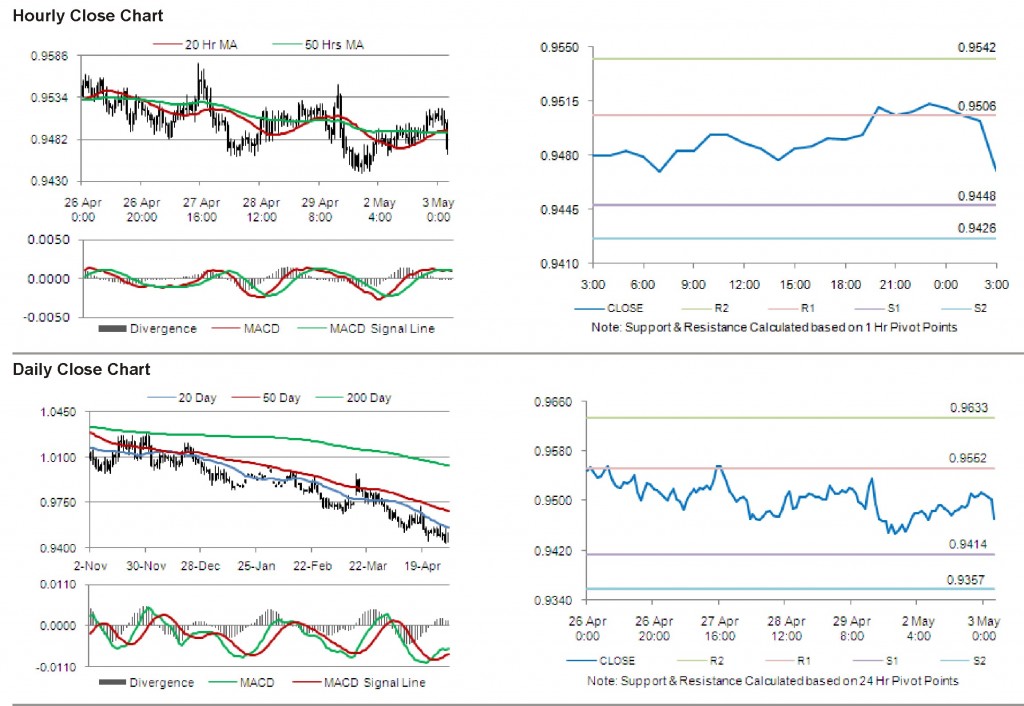

In the Asian session at 3:00GMT, the pair is trading at 0.9470, 0.45% lower from the New York session close.

The first area of short term resistance is observed at 0.9506, followed by 0.9542 and 0.9600. The first area of support is at 0.9448, with the subsequent supports at 0.9426 and 0.9368.

The currency pair is trading just below its 20 Hr moving average and its 50 Hr moving average.