For the 24 hours to 23:00 GMT, AUD strengthened 0.10% against the USD to close at 1.0946.

In Australia, the TD securities-Melbourne institute inflation gauge rose by 0.3% in April, compared to 0.6% rise in March. Additionally, house price index declined by 1.7% in the first quarter of 2011 compared to 0.7% rise in the last quarter of 2010.

In the Asian session at 3:00GMT, the pair is trading at 1.0912, 0.31% lower from the New York session close.

LME Copper prices rose 0.2% or $22.0/MT to $9,370.3/ MT. Aluminium prices advanced 1.2% or $31.8/MT to $2,771.3/ MT.

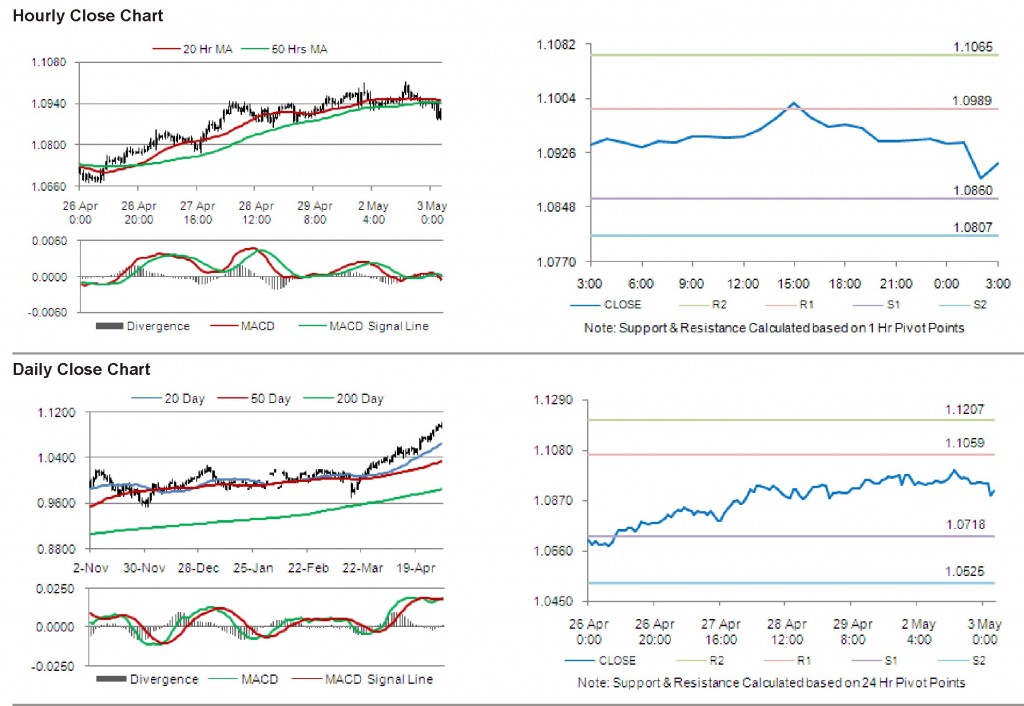

The pair is expected to find first short term resistance at 1.0989, with the next resistance levels at 1.1065 and 1.1194, subsequently. The first support for the pair is seen at 1.0860, followed by next supports at 1.0807 and 1.0678 respectively.

With a series of Australia economic releases today, including Reserve Bank of Australia’s interest rate decision and Australian Industry Group’s AiG Performance of Services Index, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.