For the 24 hours to 23:00 GMT, the USD weakened 1.03% against the JPY and closed at 101.19, hurt by a more-than-expected drop in the US ISM manufacturing PMI data for January.

In the Asian session, at GMT0400, the pair is trading at 101.27, with the USD trading 0.09% higher from yesterday’s close. Earlier today, the Bank of Japan (BoJ) Governor, Haruhiko Kuroda, in his testimony to the Japanese Parliament, stated that the “Japanese economy is making steady progress toward achieving its 2% inflation”, adding that the consumer price index in the nation could move toward its target, anytime from the latter half of FY2014 to early FY2015.

On the economic front, the BoJ reported that the monetary base in the nation increased 51.9% (YoY) in January, following a 46.6% rise recorded in the preceding month.

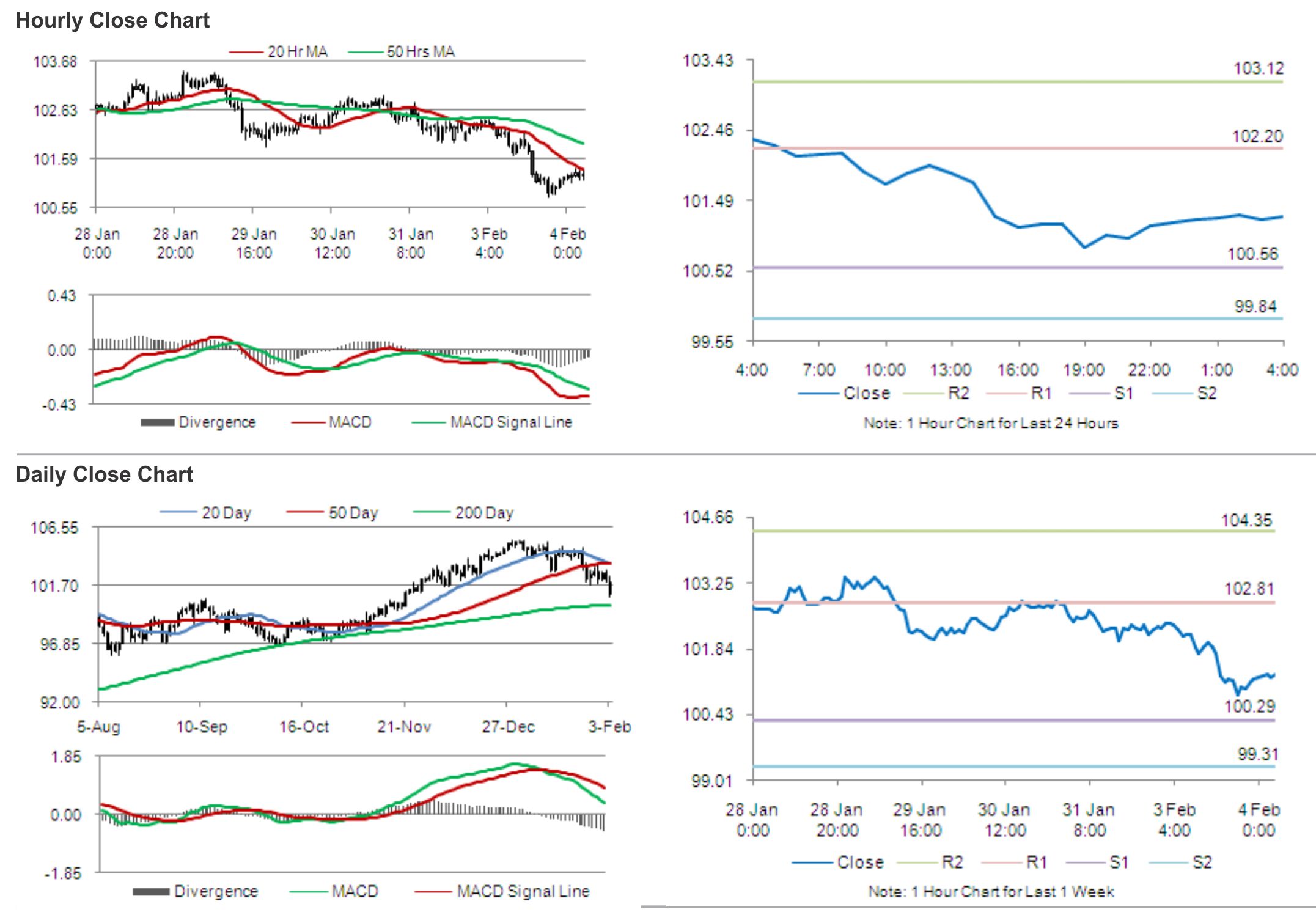

The pair is expected to find support at 100.56, and a fall through could take it to the next support level of 99.84. The pair is expected to find its first resistance at 102.20, and a rise through could take it to the next resistance level of 103.12.

Amid a lack of economic releases in Japan, during the later course of the day, traders are eyeing global economic news for further guidance in the pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.