For the 24 hours to 23:00 GMT, the USD declined 0.57% against the CHF and closed at 0.9014, following a dismal US manufacturing PMI data.

Meanwhile, the Swiss Franc advanced against its US counterpart after a report revealed that the SVME – manufacturing purchasing managers’ index (PMI) in Switzerland rose to a level of 56.1 in January, surpassing analysts’ estimate for a rise to 55.4, from previous month’s reading of 55.0.

Over the weekend, the Swiss National Bank (SNB) Vice-chairman, Jean-Pierre Danthine stated that the central bank would let go off its cap of CHF1.20 per Euro only if the inflation rate rises much higher and there was less upward pressure on the currency.

In the Asian session, at GMT0400, the pair is trading at 0.9029, with the USD trading 0.17% higher from yesterday’s close.

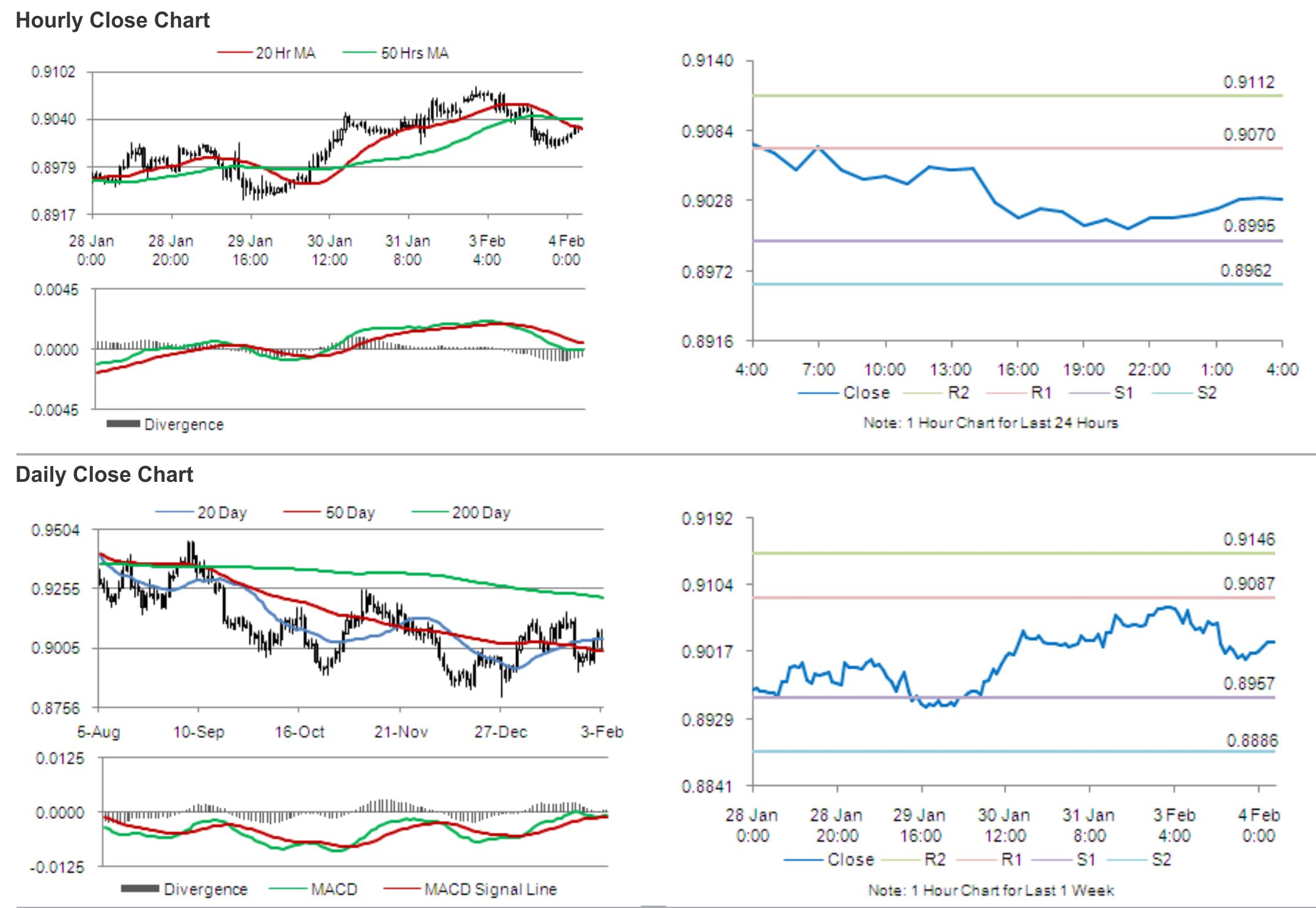

The pair is expected to find support at 0.8995, and a fall through could take it to the next support level of 0.8962. The pair is expected to find its first resistance at 0.9070, and a rise through could take it to the next resistance level of 0.9112.

With no economic release from the Swiss economy, later today, market participants are expected to keep a tab on global economic news for further guidance in the pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.