On Friday, the USD weakened 0.34% against the JPY and closed at 101.83, as a lacklustre US industrial production data and continuous unfavourable climatic conditions spurred concerns about the recovery of the US economy.

On Saturday, Chief Cabinet Secretary, Yoshihide Suga, revealed Japan Prime Minister, Shinzo Abe’s plans to slash corporate tax rate in the nation. Furthermore, he dismissed concerns on the impact of a corporate tax cut on the public debt, by stating that, “the cabinet would achieve the two extremely difficult goals of escaping deflation and rebuilding the government finances.”

In the Asian session, at GMT0400, the pair is trading at 101.60, with the USD trading 0.23% lower from Friday’s close. The yen benefitted from the typical ‘risk off’ trades following soft Japanese GDP data.

On a seasonally adjusted basis, Japan’s GDP rose 0.3% (QoQ) in the fourth quarter, less than market expectations for a 0.7% rise and compared to similar rate of rise recorded in the preceding quarter. Separately, industrial production in Japan rose less-than-expected 0.9% MoM in December, compared to a 0.1% drop registered in the preceding month.

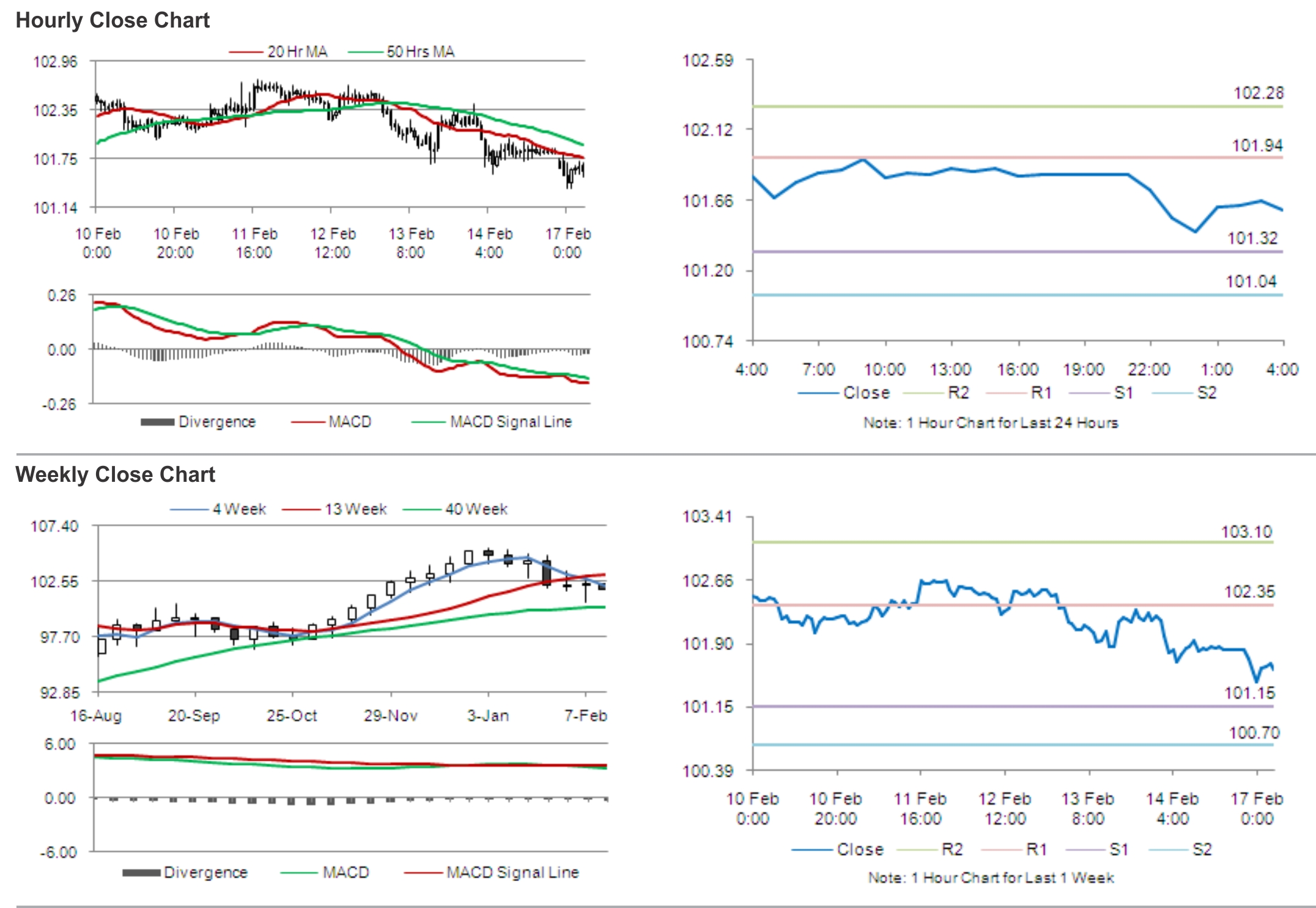

The pair is expected to find support at 101.32, and a fall through could take it to the next support level of 101.04. The pair is expected to find its first resistance at 101.94, and a rise through could take it to the next resistance level of 102.28.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.