On Friday, GBP rose 0.48% against the USD and closed at 1.6737.

The US Dollar lost ground against the British Pound after data showed that the US industrial production unexpectedly dropped 0.3% (MoM) in January, failing to meet market expectations for a 0.3% rise. However, an upbeat Reuters/ Michigan US consumer confidence data kept the greenback’s losses in check.

Meanwhile, in the UK, DBRS Ratings Limited confirmed the UK’s “AAA” sovereign rating with a stable outlook. Separately, on Saturday, the Bank of England (BoE) Governor, Mark Carney cautioned that the UK Chancellor, David Cameron’s plans for a referendum on Britain’s membership of the European Union could weigh on the nation’s economic recovery.

In the Asian session, at GMT0400, the pair is trading at 1.6787, with the GBP trading 0.30% higher from Friday’s close.

Early morning, the BoE Governor, Mark Carney hinted that a hike in the central bank’s benchmark interest rate was not possible until the nation witnesses an improvement in its labour market conditions. He further indicated that the forces operating against an interest rate hike would persist for some more time.

On the economic front, the UK Rightmove house price index rose 3.3% on a monthly basis in February, following a 1.0% rise registered in the preceding month.

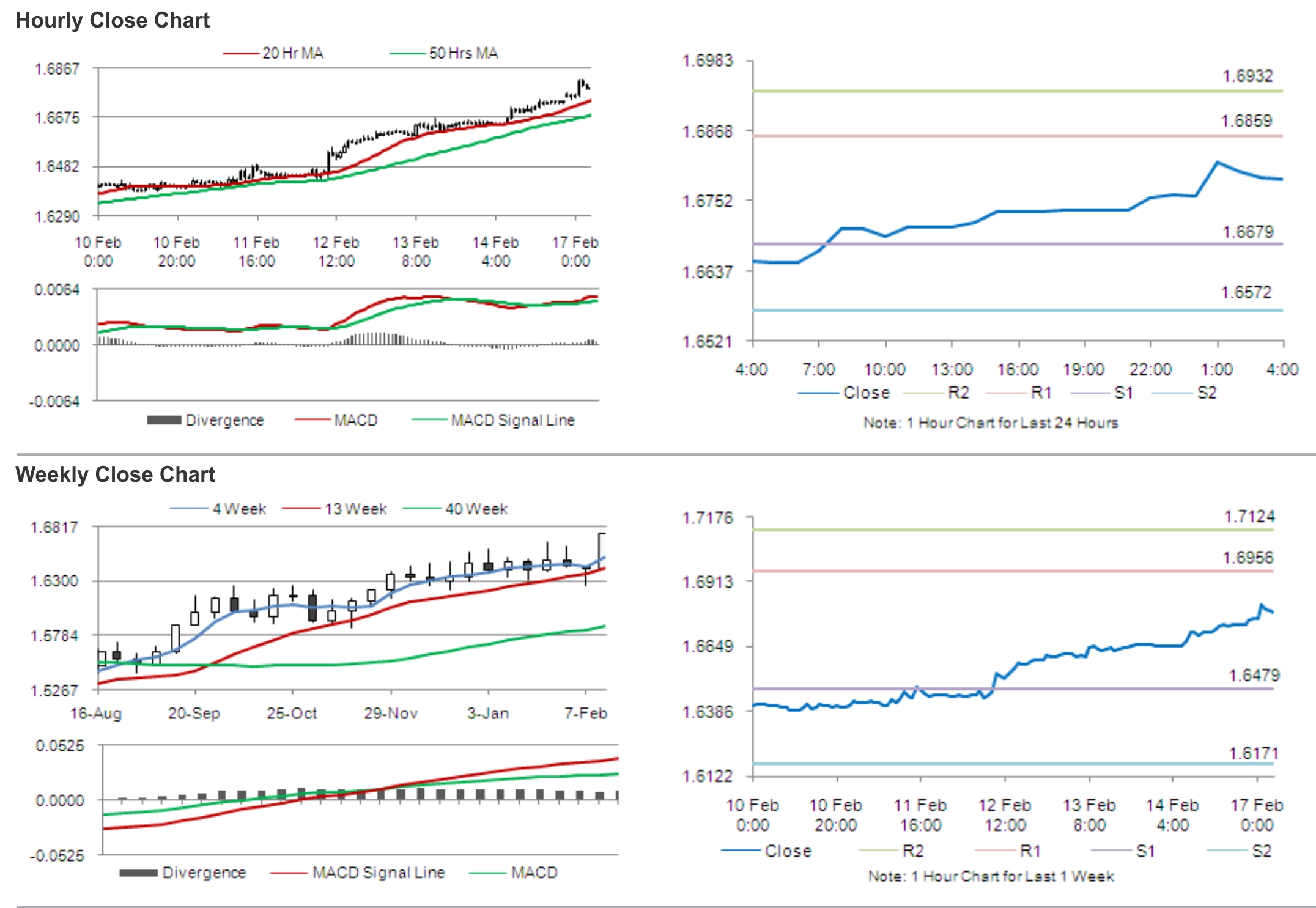

The pair is expected to find support at 1.6679, and a fall through could take it to the next support level of 1.6572. The pair is expected to find its first resistance at 1.6859, and a rise through could take it to the next resistance level of 1.6932.

Amid a lack of economic releases in the UK, during the later course of the day, traders would be eyeing global economic news for further cues in the Sterling.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.