For the 24 hours to 23:00 GMT, the USD strengthened 0.53% against the JPY and closed at 102.08.

Yesterday, the IMF forecasted that the public debt in Japan would fall by 2018, citing two consumption tax hikes and speedier economic growth in Japan,

On the economic front, industrial production in Japan rose 0.9% (MoM) in December, failing to meet analysts’ expectations for a rise of 1.1% and compared to a 0.1% drop registered in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 102.53, with the USD trading 0.44% higher from yesterday’s close. The Japanese Yen lost momentum this morning after the Bank of Japan (BoJ) announced the expansion and enlargement of two lending programs, set to expire at the end of March, and voted unanimously to keep its monetary policy unchanged at its February policy meeting. The central bank reiterated its upbeat view on Japan’s economic growth and maintained its pledge of increasing its monetary base at an annual pace of ¥60 trillion to ¥70 trillion.

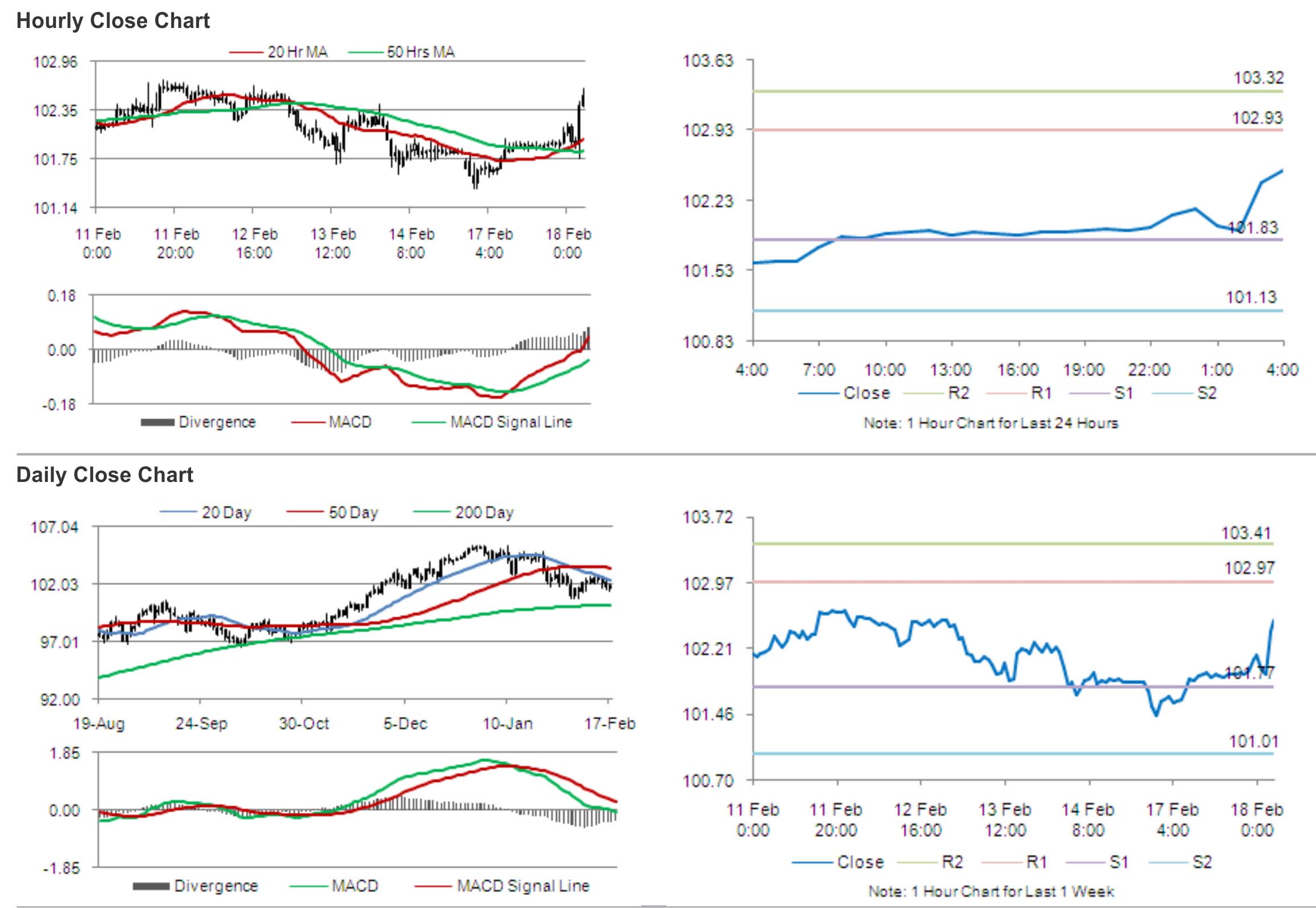

The pair is expected to find support at 101.83, and a fall through could take it to the next support level of 101.13. The pair is expected to find its first resistance at 102.93, and a rise through could take it to the next resistance level of 103.32.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.