For the 24 hours to 23:00 GMT, GBP fell 0.26% against the USD and closed at 1.6719.

Yesterday, the Bank of England (BoE) policy-maker, David Miles, hinted that interest rates in the nation would not remain at current low level for a very long time. Additionally, he opined that inflation pressures in the nation would remain “subdued” and Britain’s economic growth may accelerate more than the BoE’s growth-projection. Furthermore, he dismissed concerns on the UK housing market.

In the Asian session, at GMT0400, the pair is trading at 1.6732, with the GBP trading 0.08% higher from yesterday’s close.

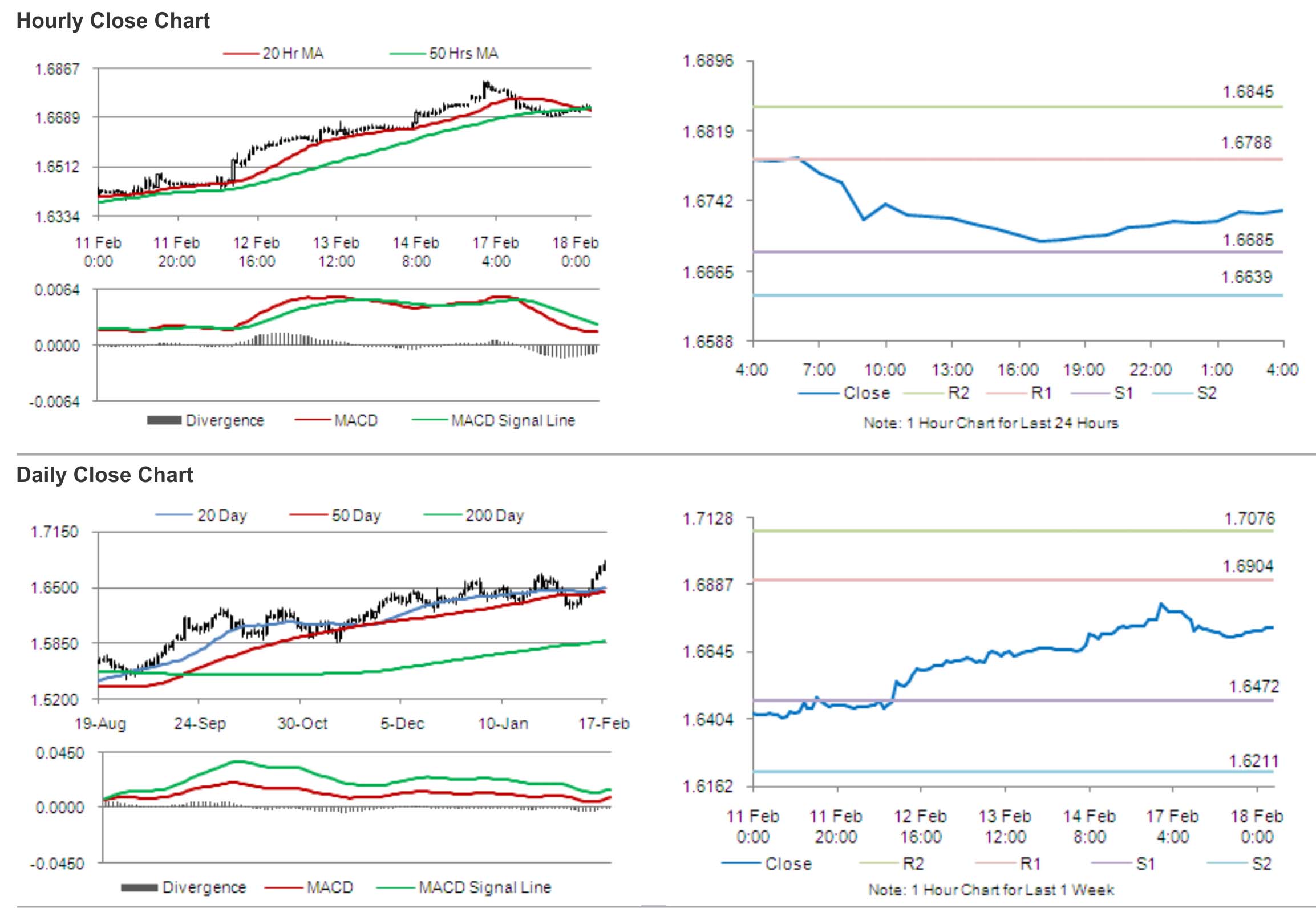

The pair is expected to find support at 1.6685, and a fall through could take it to the next support level of 1.6639. The pair is expected to find its first resistance at 1.6788, and a rise through could take it to the next resistance level of 1.6845.

Later today, the National Statistics is expected to report the UK’s consumer inflation, producer inflation and retail sales data for January.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.