For the 24 hours to 23:00 GMT, the USD weakened 0.37% against the JPY and closed at 101.92. The Japanese Yen advanced as lingering tensions between the Western nations and Russia fuelled demand for safe-haven assets. Yesterday, at a summit in Brussels, the US President, Barack Obama warned Russia that it could face further isolation and “costs” if Moscow does not change its course over Ukraine.

Meanwhile in Japan, Economics Minister Akira Amari indicated that the Bank of Japan (BoJ) still has a role to play in ensuring a sustained end to deflation in the economy. However, at the same time he did not pressure the central bank to expand stimulus immediately by stating that it was up to the BOJ to decide if and when to ease policy further.

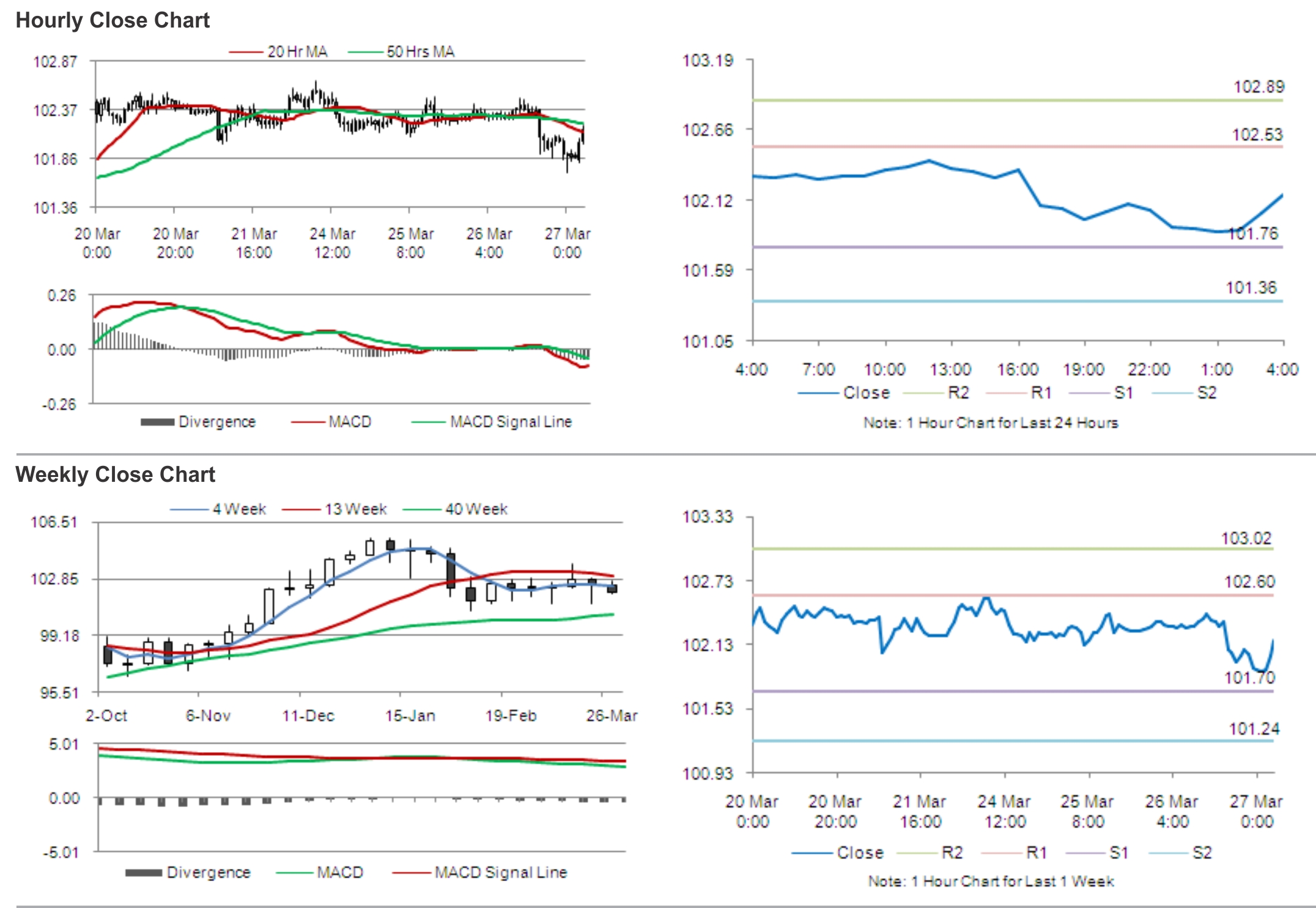

In the Asian session, at GMT0400, the pair is trading at 102.17, with the USD trading 0.24% higher from yesterday’s close.

The pair is expected to find support at 101.76, and a fall through could take it to the next support level of 101.36. The pair is expected to find its first resistance at 102.53, and a rise through could take it to the next resistance level of 102.89.

Market participants keenly await Japan’s consumer inflation, unemployment rate and retail trade data, for further cues in the Yen.

The currency pair is trading above its 20 Hr moving average and is showing convergence with its 50 Hr moving average.