For the 24 hours to 23:00 GMT, GBP rose 0.27% against the USD and closed at 1.6578, after a Bank of England (BoE) policymaker, Martin Weale projected interest rates in the nation to gradually rise to a more normal level with a pickup in the UK’s economic recovery. Furthermore, he citied an improvement in British wage growth and highlighted the possibility for the Britain economy to benefit from a rise in income and wages.

In the Asian session, at GMT0400, the pair is trading at 1.6584, with the GBP trading marginally higher from yesterday’s close.

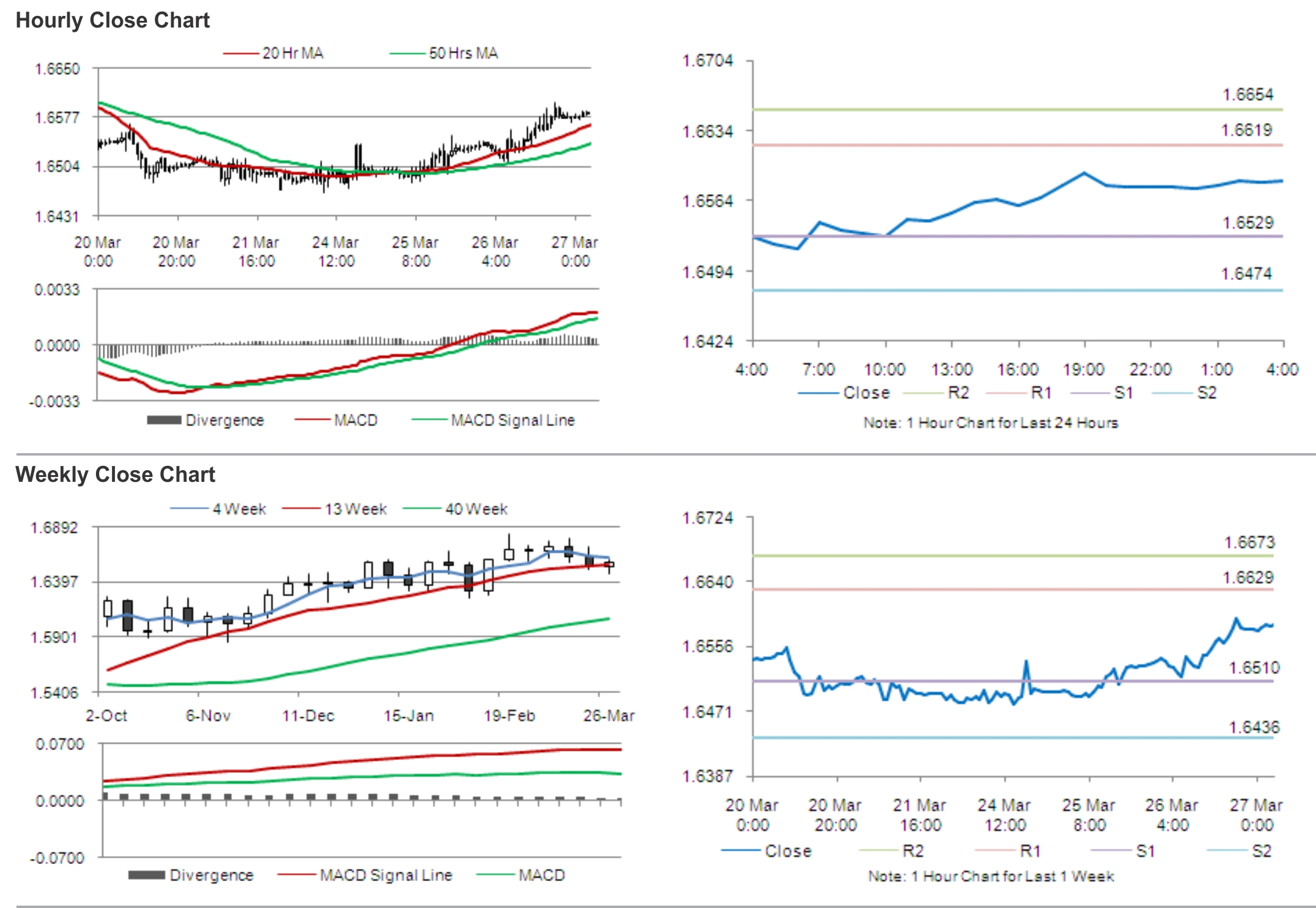

The pair is expected to find support at 1.6529, and a fall through could take it to the next support level of 1.6474. The pair is expected to find its first resistance at 1.6619, and a rise through could take it to the next resistance level of 1.6654.

Later today, the National Statistics is scheduled to report the trend in the UK retail sales, which is expected to rebound in February on a month-on-month basis.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.