For the 24 hours to 23:00 GMT, the USD rose 0.15% against the CAD to close at 1.0965, benefitting from a strong US ADP employment data and the Fed’s decision to taper its QE package by $10 billion. However, earlier the greenback came under pressure following the release of a dismal US GDP data for the first-quarter.

Meanwhile, Canada’s economy registered a 0.2% growth in February, in-line with market estimates and following a 0.5% expansion in January. However, Canadian industrial product price and raw materials prices failed to meet market expectations for March.

In the Asian session, at GMT0300, the pair is trading at 1.0973, with the USD trading 0.07% higher from yesterday’s close.

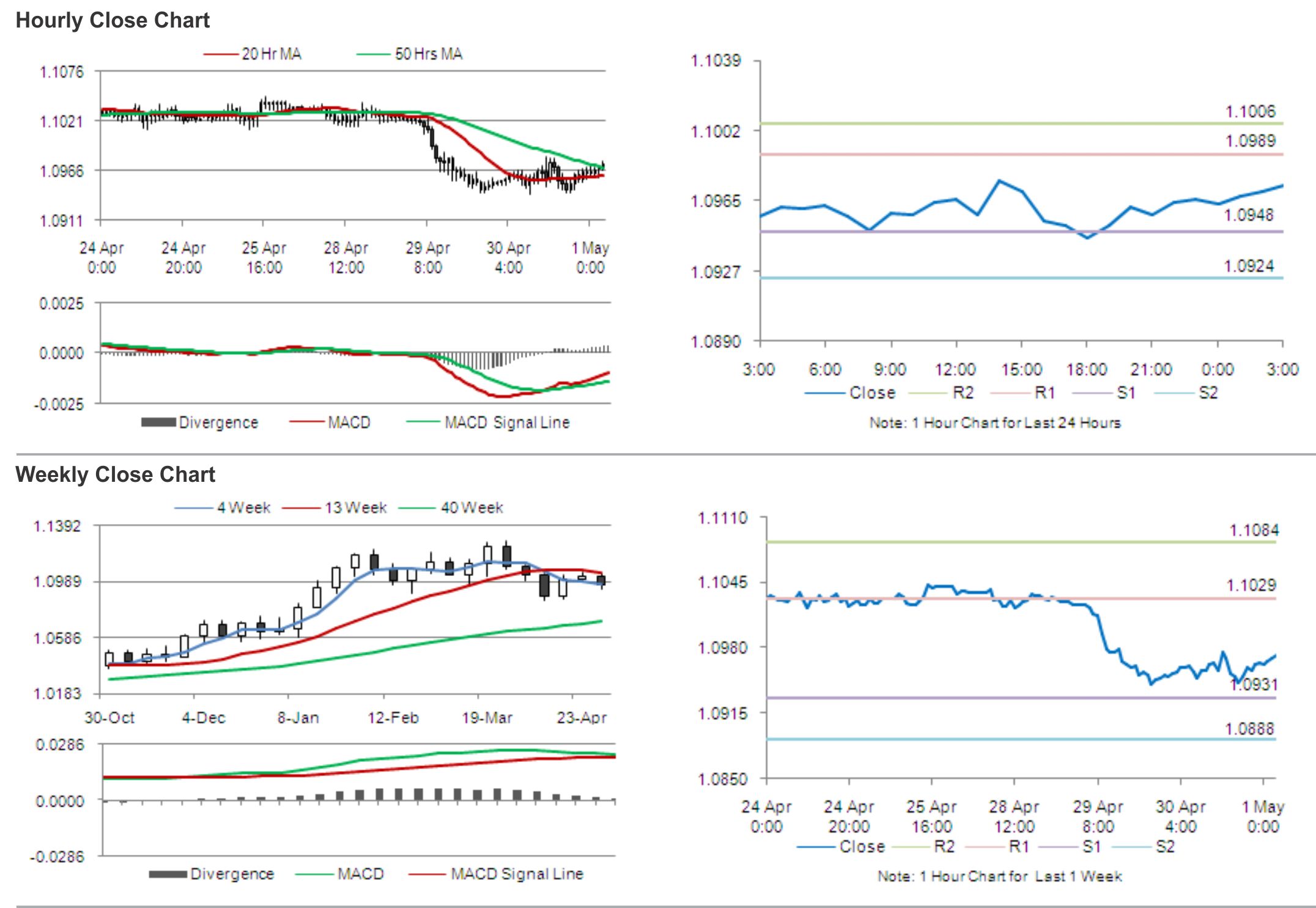

The pair is expected to find support at 1.0948, and a fall through could take it to the next support level of 1.0924. The pair is expected to find its first resistance at 1.0989, and a rise through could take it to the next resistance level of 1.1006.

Traders are expected to keep a tab on global economic news and also on the release of the ISM manufacturing PMI data from the US economy, fort further cues in the currency pair.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.