For the 24 hours to 23:00 GMT, the USD declined 0.38% against the CHF and closed at 0.8802, as a downbeat US GDP data for the first quarter disappointed market sentiment.

On the economic front, the UBS consumption indicator in Switzerland rose to a reading of 1.84 in March, from a level of 1.52 in February while the Swiss KOF leading indicator fell for a second month to a figure of 102.0 in April from a revised reading of 106.3 in March.

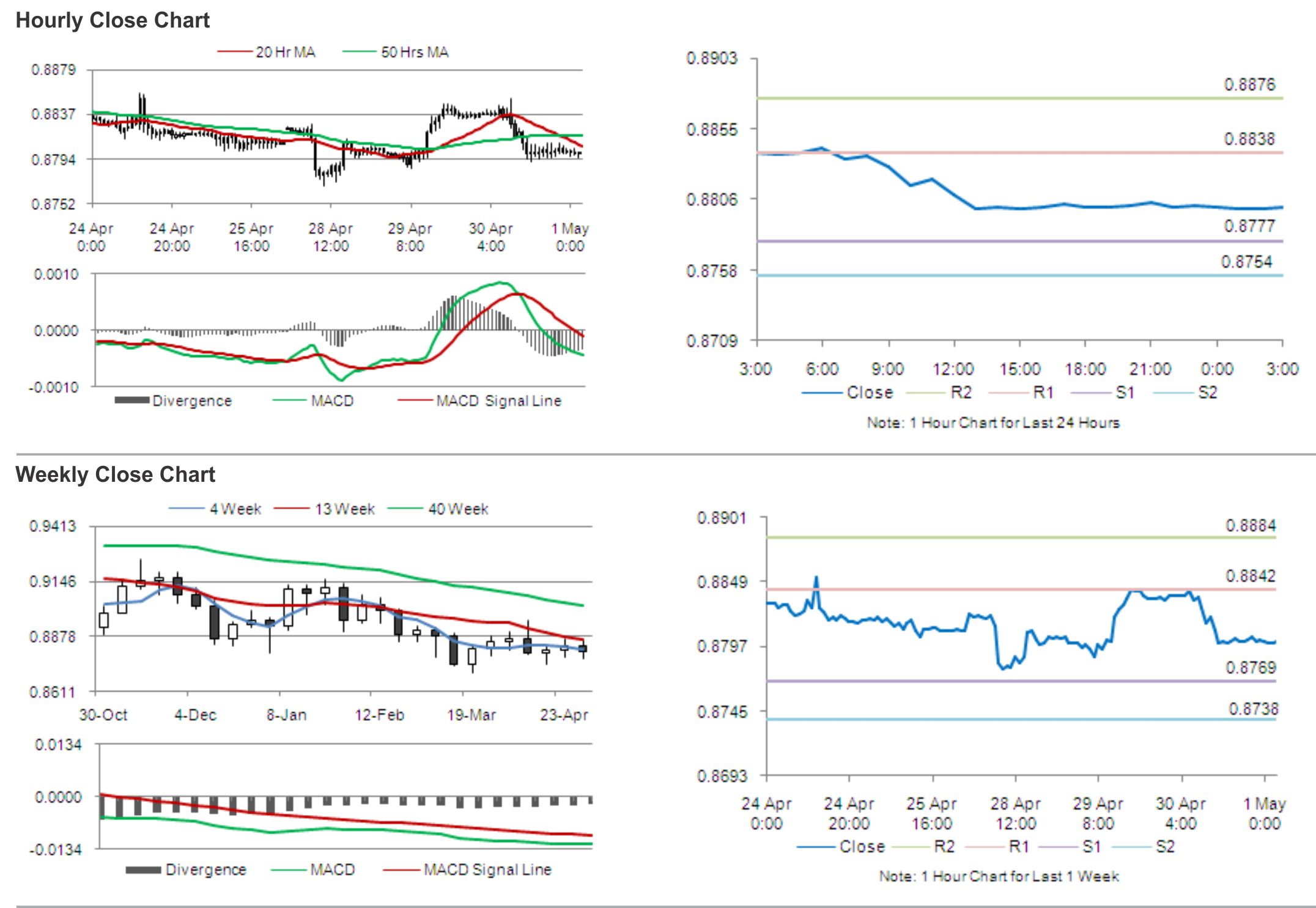

In the Asian session, at GMT0300, the pair is trading at 0.8801, with the USD trading a tad lower from yesterday’s close, ahead of the US ISM manufacturing PMI data.

The pair is expected to find support at 0.8777, and a fall through could take it to the next support level of 0.8754. The pair is expected to find its first resistance at 0.8838, and a rise through could take it to the next resistance level of 0.8876.

Amid no major economic releases in Switzerland due to a public holiday, market participants are expected to keep a tab on global economic news for further cues in the pair.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.