For the 24 hours to 23:00 GMT, USD rose 0.88% against the CAD to close at 0.9665, as crude oil prices slumped below $100 per barrel on speculation of slower global economic growth.

The Richard Ivey School of Business reported that Purchasing Managers Index (PMI) in Canada dropped to a reading of 57.7 in April. Additionally, building permits surged17.2% MoM in March, the highest level since June of 2007.

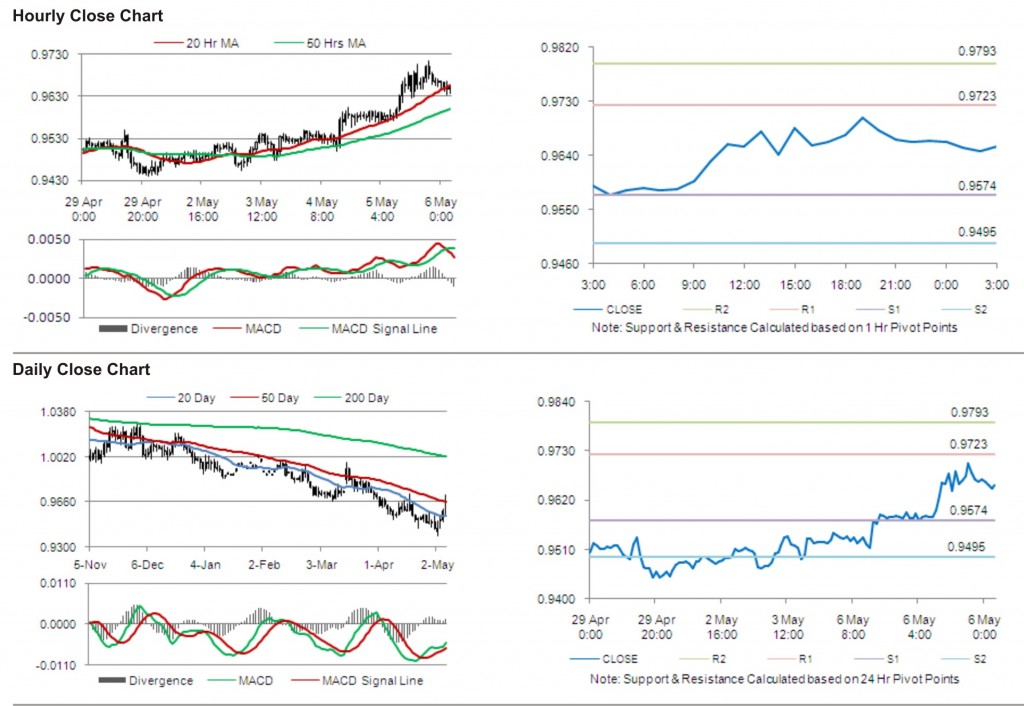

In the Asian session at 3:00GMT, the pair is trading at 0.9654, 011% lower from the New York session close.

The first area of short term resistance is observed at 0.9723, followed by 0.9793 and 0.9942. The first area of support is at 0.9574, with the subsequent supports at 0.9495 and 0.9346.

The pair is expected to trade on the cues from the release of unemployment rate and net change in employment in Canada.

The currency pair is showing convergence with 20 Hr moving average and is trading just below its 50 Hr moving average.