For the 24 hours to 23:00 GMT, AUD weakened 1.39% against the USD to close at 1.0603, amid fall in commodities and as Australian retail sales for March, unexpectedly declined.

In Australia, the Bureau of Statistics reported that the nation’s retail sales unexpectedly declined 0.5% in March.

In the Asian session at 3:00GMT, the pair is trading at 1.0706, 0.97% higher from the New York session close, after the Reserve Bank hinted in its quarterly statement interest rates are set to rise.LME Copper prices declined 4.2% or $380.8/MT to $ 8790.5/ MT. Aluminium prices dropped 2.6% or $72.8/MT to $ 2680.5/ MT.

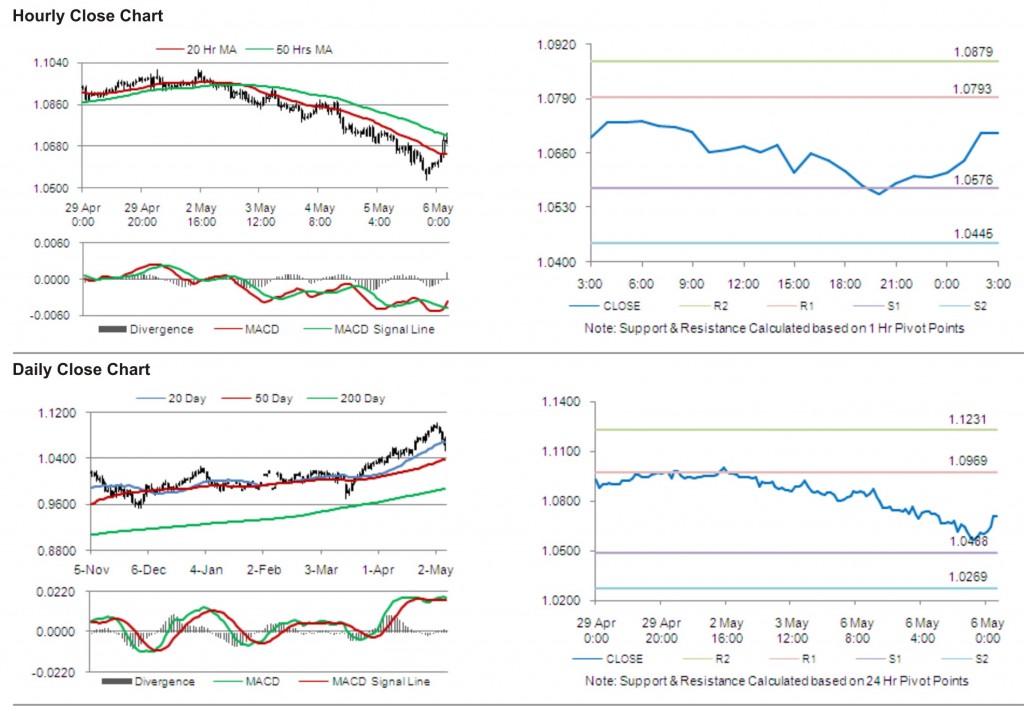

The pair is expected to find first short term resistance at 1.0793, with the next resistance levels at 1.0879 and 1.1096, subsequently. The first support for the pair is seen at 1.0576, followed by next supports at 1.0445 and 1.0228 respectively.

Trading trends in the pair are expected to be determined by release of RBA monetary policy statement in Australia.

The currency pair is showing convergence with 50 Hr moving average and is trading far above its 20 Hr moving average.