For the 24 hours to 23:00 GMT, the AUD weakened 0.42% against the USD to close at 0.9328.

LME Copper prices rose 0.8% or $59.0/MT to $7009.0/MT. Aluminium prices declined 0.4% or $7.0/MT to $1724.5/MT.

In the Asian session, at GMT0300, the pair is trading at 0.9308, with the AUD trading 0.21% lower from yesterday’s close, after the RBA Assistant Governor, Guy Debelle cautioned that the Australian Dollar would depreciate due to weak capital inflows in the Australian economy.

The Australian Dollar further came under pressure after the Reserve Bank of Australia (RBA)’s May policy meeting minutes indicated that the central bank expects low rates to remain in place “for some time yet”. Additionally, the minutes highlighted policymakers’ view for the central bank’s accommodative policy stance to be appropriate for the moment as overall growth in the Australian economy could likely be below trend in the coming quarters.

Separately, the Australian Prime Minister, Tony Abbott opined that his nation’s “AAA” sovereign rating could come under threat if the opposition lawmakers blocked the government’s efforts to curb spending. However, Secretary to the Treasury, Martin Parkinson highlighted some positive signs in the nation’s household sector and indicated that the non-mining industries in Australia would have to perform better to keep the unemployment rate in the economy low.

In economic news, Australia’s CB leading indicator registered a flat reading in March, following a 0.2% rise in the previous month.

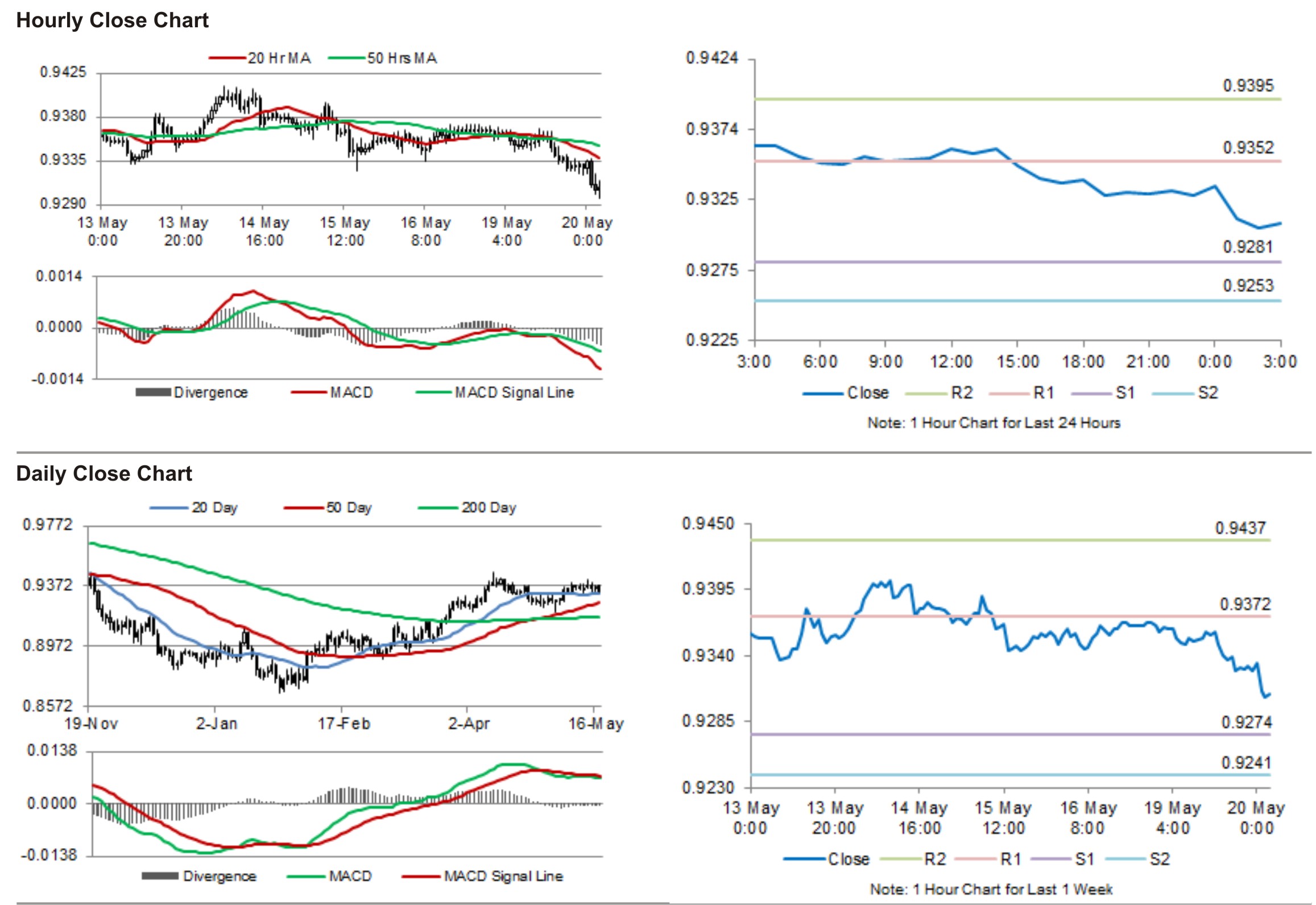

The pair is expected to find support at 0.9281, and a fall through could take it to the next support level of 0.9253. The pair is expected to find its first resistance at 0.9352, and a rise through could take it to the next resistance level of 0.9395.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.