For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.3699, as risk appetite among traders declined after data showed that producer prices in Germany, the largest economy in the Euro-zone, fell more-than-expected, on an annual basis, in April and as the ECB Governing Council member, Erkki Liikanen hinted that the central bank is willing to deploy “non-traditional measures”, including an asset-purchase programme, if deflation risks increase significantly in the Euro-zone economy. However, the common currency received some support after industrial orders in Italy rebounded 1.3% (MoM) in March while industrial sales also followed suit and registered a month-on-month increase of 0.3%.

Meanwhile, in the US, the Philadelphia Fed President, Charles Plosser projected an earlier than expected rise in the nation’s benchmark inflation rate and urged the US central bank to taper the size of its stimulus package at a faster pace as, according to him, currently “the US economy is on a firmer footing than it was in several years.” However, another Fed policymaker, William Dudley, the President of the New York Fed, indicated that the pace of hiking interest rate in the world’s largest economy would be relatively slow and that it would mainly depend on the nation’s economic performance and on the reaction of the financial markets.

In the Asian session, at GMT0300, the pair is trading at 1.3702, with the EUR trading marginally higher from yesterday’s close.

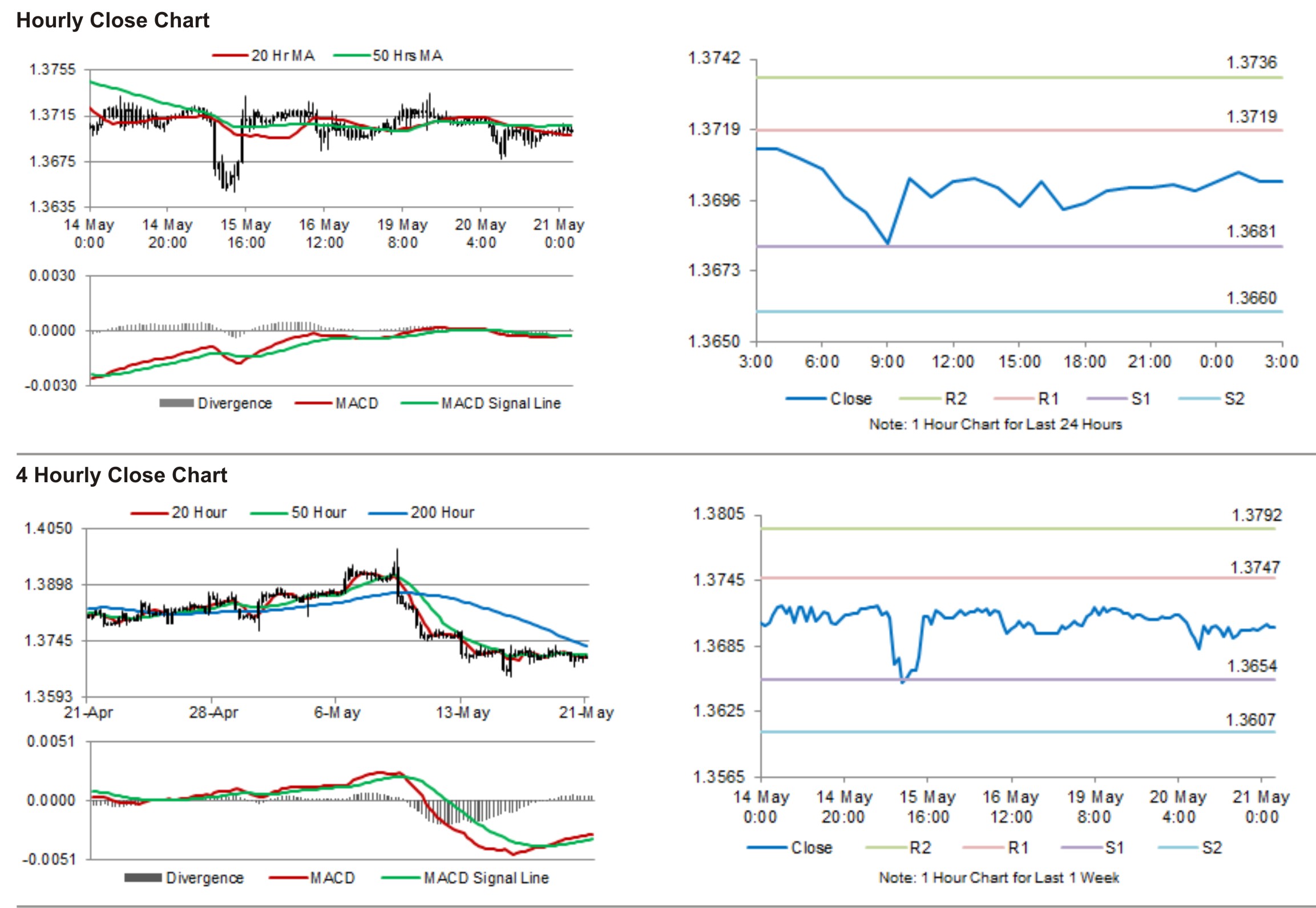

The pair is expected to find support at 1.3681, and a fall through could take it to the next support level of 1.3660. The pair is expected to find its first resistance at 1.3719, and a rise through could take it to the next resistance level of 1.3736.

Later today, traders would keep a close eye on Euro-zone’s current account and consumer confidence data, along with the minutes of the Fed’s latest policy meeting and a planned speech by the Fed Chief, Janet Yellen, for further cues in the currency pair.

The currency pair is showing convergence with its 20 Hr mving average and is trading just below its 50 Hr moving average.