For the 24 hours to 23:00 GMT, the USD weakened 0.19% against the JPY and closed at 101.31.

Yesterday, in Japan, an ex-BoJ economist, Hideo Hayakawa cautioned that the next policy action by the BoJ should be tapering the size of its massive stimulus package rather than expanding the same, as the costs of increasing bond purchases would be more than its benefits.

In economic news, Japan’s leading economic index dropped to a one-year low reading of 107.1 in March while its coincident index rose more than estimates to a reading of 114.5.

In the Asian session, at GMT0300, the pair is trading at 101.19, with the USD trading 0.12% lower from yesterday’s close.

The Japanese Yen gained ground after the BoJ kept its interest rate unchanged at 0.1% and maintained its pledge to increase the central bank’s monetary base at an annual pace of ¥60-70 trillion at the conclusion of its two-day policy meeting,. Meanwhile, Japan’s central bank also expressed confidence in the nation in achieving its 2.0% inflation target while noting an improvement in the nation’s business spending and corporate profits.

On the macro front, Japan’s total merchandised trade deficit shrank 7.8% (YoY) in April, with a score of ¥808.9 billion, as imports rose at the slowest pace in 16 months.

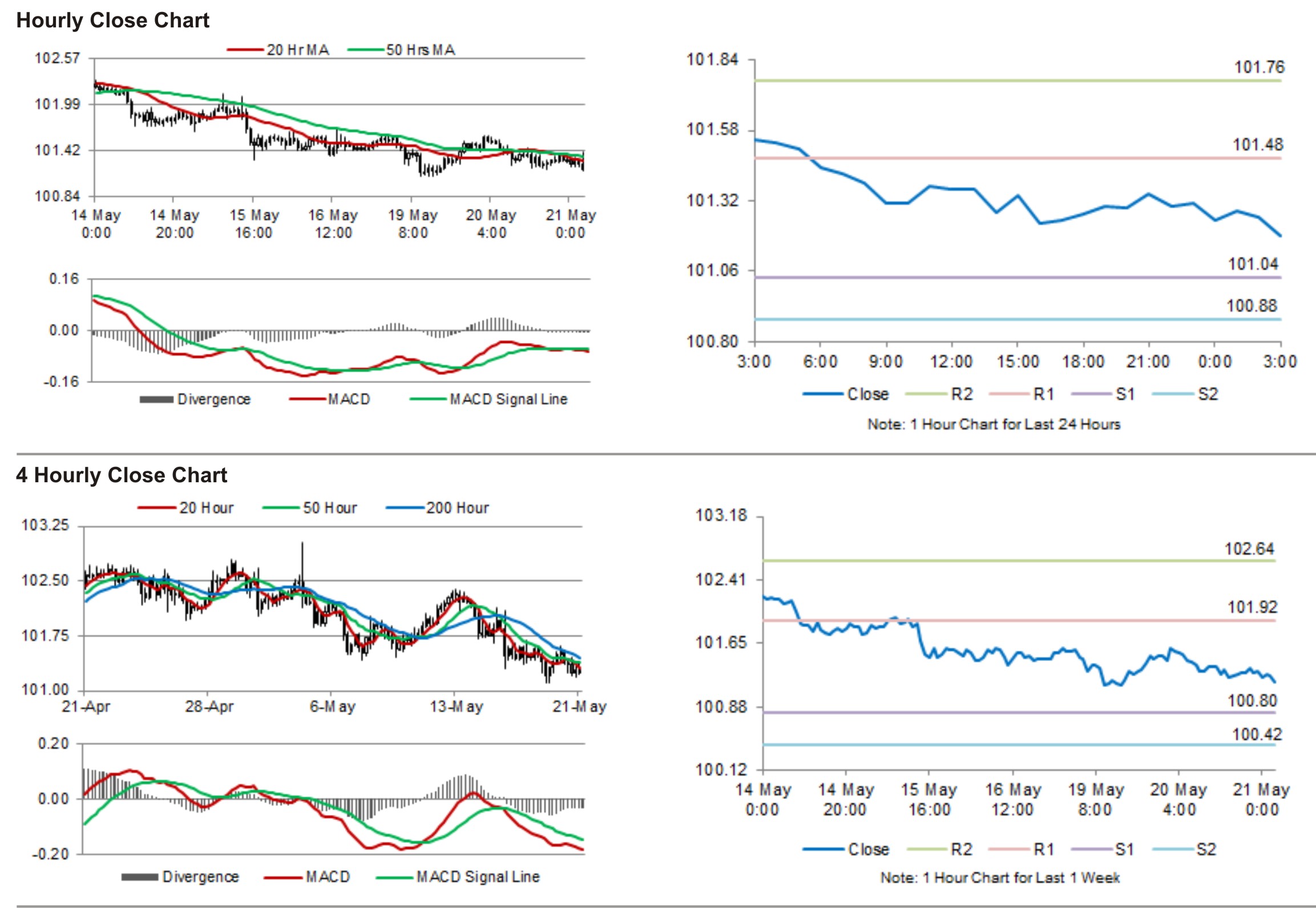

The pair is expected to find support at 101.04, and a fall through could take it to the next support level of 100.88. The pair is expected to find its first resistance at 101.48, and a rise through could take it to the next resistance level of 101.76.

During the later course of the day, market participants would eye the BOJ’s press conference and the release of a monthly report by the BoJ on the economic condition of Japan.

The currency pair is trading just below its 20 Hr and 50 Hr moving averages.