For the 24 hours to 23:00 GMT, the GBP rose 0.13% against the USD and closed at 1.6836 after data showed that UK consumer inflation rate rose for the first time in 10 months to an annual rate of 1.8% in April. However, UK’s producer price index, retail price index and house price index failed to match market expectations for April.

Meanwhile, UK Prime Minister, David Cameron agreed to the BoE’s view that the booming housing market posed a risk to the nation’s economic recovery and expressed his willingness to scale back his ‘Help to Buy’ mortgage guarantee scheme if the BoE felt it is contributing to a housing bubble. Separately, the BoE Deputy Governor, Charlie Bean projected interest rates to gradually rise in the UK economy while indicating that the central bank would find it difficult to “exit from its exceptionally stimulatory monetary stance.” Additionally, he acknowledged the perils of UK’s booming housing market and opined that an interest rate hike can be the only effective tool to cool the housing market.

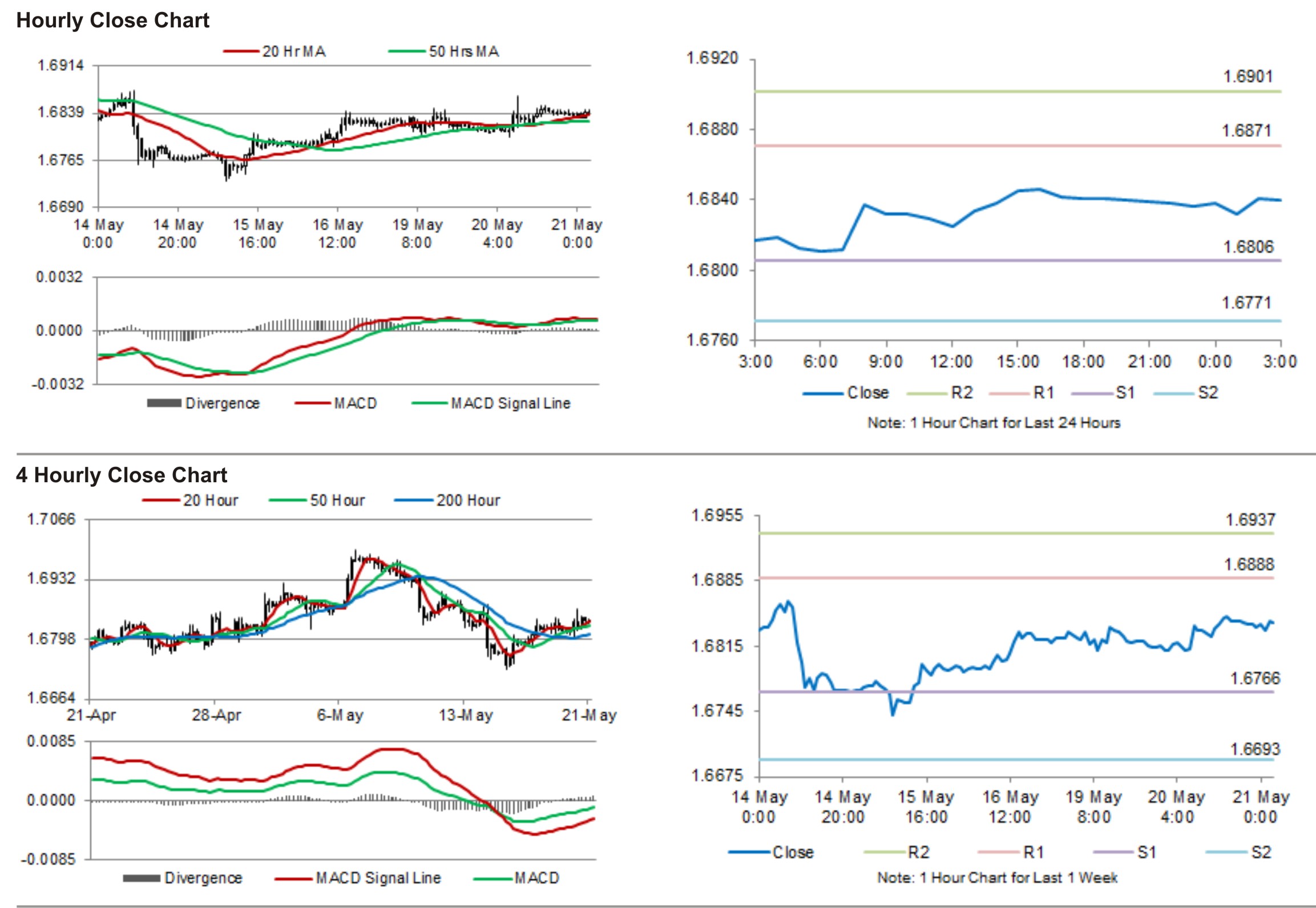

In the Asian session, at GMT0300, the pair is trading at 1.6840, with the GBP trading a tad higher from yesterday’s close.

The pair is expected to find support at 1.6806, and a fall through could take it to the next support level of 1.6771. The pair is expected to find its first resistance at 1.6871, and a rise through could take it to the next resistance level of 1.6901.

Looking ahead, UK’s retail sales data and the minutes from the BoE’s latest policy meeting would be keenly eyed for further cues in the British Pound.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.