For the 24 hours to 23:00 GMT, the USD strengthened 0.13% against the JPY and closed at 101.44, as the minutes from the Fed’s April policy meeting showed that policymakers would continue tapering the size of its QE package in the coming months. However, earlier during the day, the Japanese Yen rose against the US Dollar after the BoJ Governor, Haruhiko Kuroda, at a press conference, expressed confidence in the recovery of the world’s third largest economy without signalling the need for further stimulus measures. Furthermore, the BoJ Governor shrugged off concerns on the recent appreciation in the Yen and indicated that the central bank’s QE is having its intended effect on pushing inflation to the BoJ’s 2.0% target.

In the Asian session, at GMT0300, the pair is trading at 101.54, with the USD trading 0.10% higher from yesterday’s close.

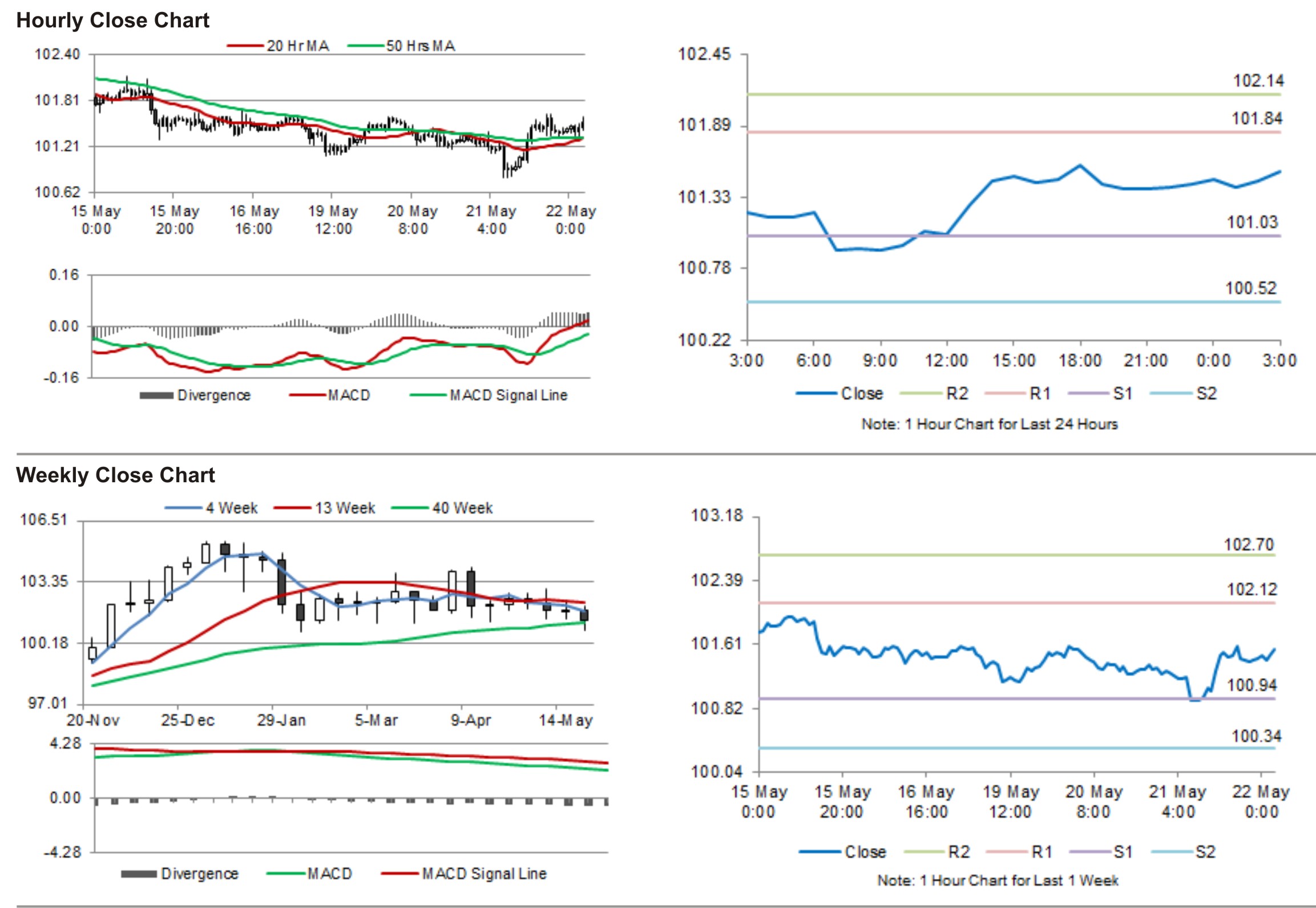

The pair is expected to find support at 101.03, and a fall through could take it to the next support level of 100.52. The pair is expected to find its first resistance at 101.84, and a rise through could take it to the next resistance level of 102.14.

During the later course of the day, the BoJ is scheduled to publish its monthly survey on the economic conditions of Japan.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.