For the 24 hours to 23:00 GMT, the GBP rose 0.37% against the USD and closed at 1.6899 after data showed that annual retail sales in the UK economy rose at the fastest pace in 10 years in April and as the minutes from the BoE’s May policy meeting hinted that the time for an interest rate hike in the Britain economy was inching closer. The minutes also revealed that all of the 9 BoE MPC members voted unanimously to keep the central bank’s benchmark interest rate at a record low 0.5% and the size of its bond purchases at £375.0 billion even as they expressed different views on the amount of slack in the UK’s labour marker and the strategies to be implemented for eventually raising rates..

In the Asian session, at GMT0300, the pair is trading at 1.6888, with the GBP trading 0.07% lower from yesterday’s close.

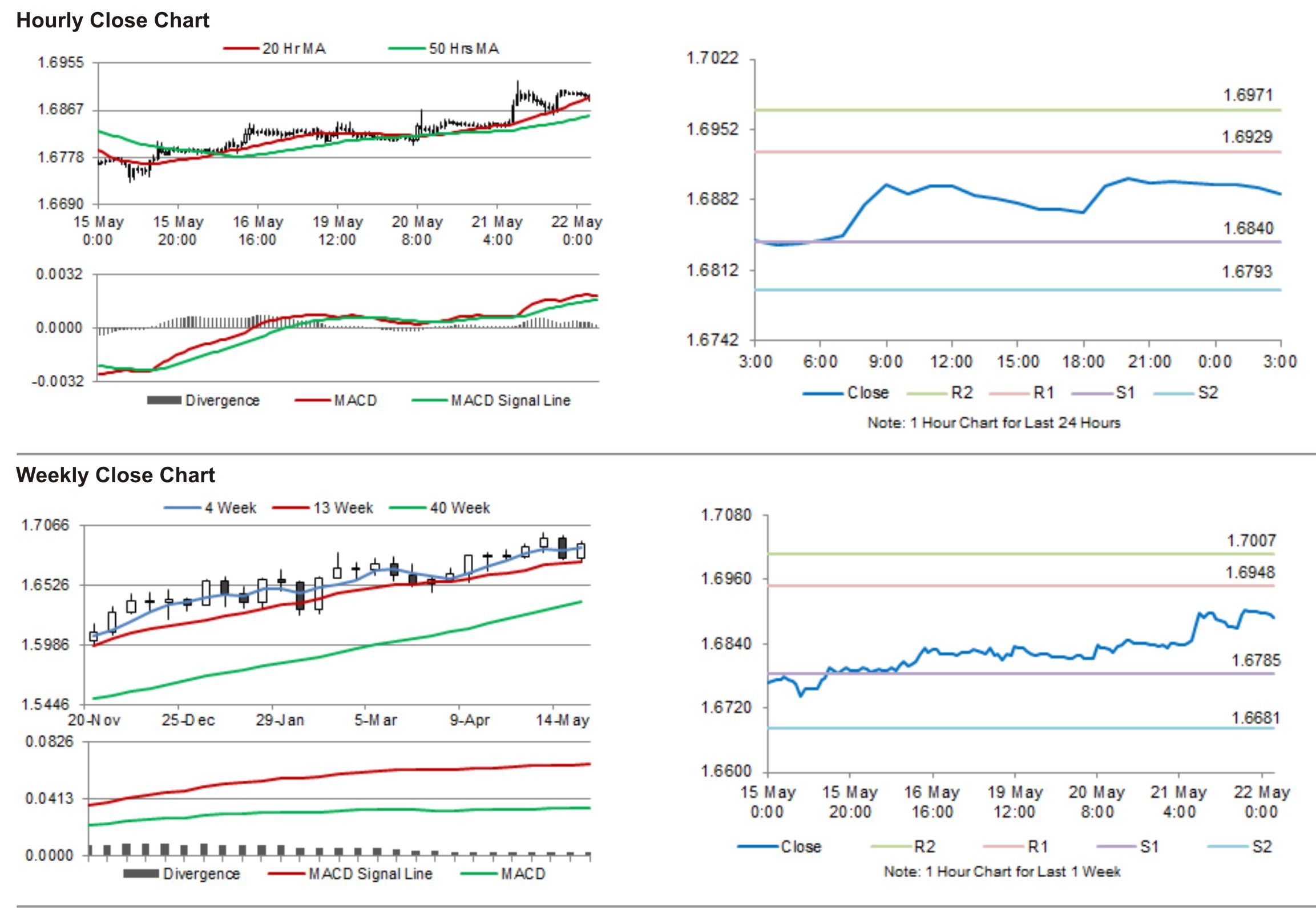

The pair is expected to find support at 1.6840, and a fall through could take it to the next support level of 1.6793. The pair is expected to find its first resistance at 1.6929, and a rise through could take it to the next resistance level of 1.6971.

Market participants keenly await UK’s GDP data, which is widely expected to show that the Britain economy recorded a similar pace of growth in the preceding quarter. Traders are also expected to keep a tab on the UK’s BBA mortgage approvals data for April, which would provide an insight into the housing market conditions in the economy.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.