For the 24 hours to 23:00 GMT, the EUR declined 0.30% against the USD and closed at 1.3594, as data showed that unemployment in Germany, the largest economy in the Euro-zone, unexpectedly rose for the first time in six months in May. Negative sentiment was also fuelled as the ECB Vice President, Vitor Constancio, expressed concerns over the risks which may be triggered by a prolonged period of low inflation in the economy, and after another ECB policymaker, Yves Mersch, hinted that the Governing Council was comfortable using both conventional and unconventional measures to tackle low inflation and low credit growth in the Euro-zone economy. Separately, the ECB, in its semi-annual Financial Stability Review, cautioned that a reversal of “fickle” capital inflows from the Euro-zone’s financial markets would pose a risk to the economy.

In other economic news, economic sentiment in the Euro-zone economy improved more-than-expected to a 34-month high level of 102.7 in May while an index on the Euro-zone consumer confidence improved to a reading of -7.1 in May, the highest level since September 2007. Separately, data from Euro-zone’s member nations showed that French consumer spending and producer prices registered a month-on-month fall in April while Italy’s business confidence defied economists’ expectations and stood pat in May.

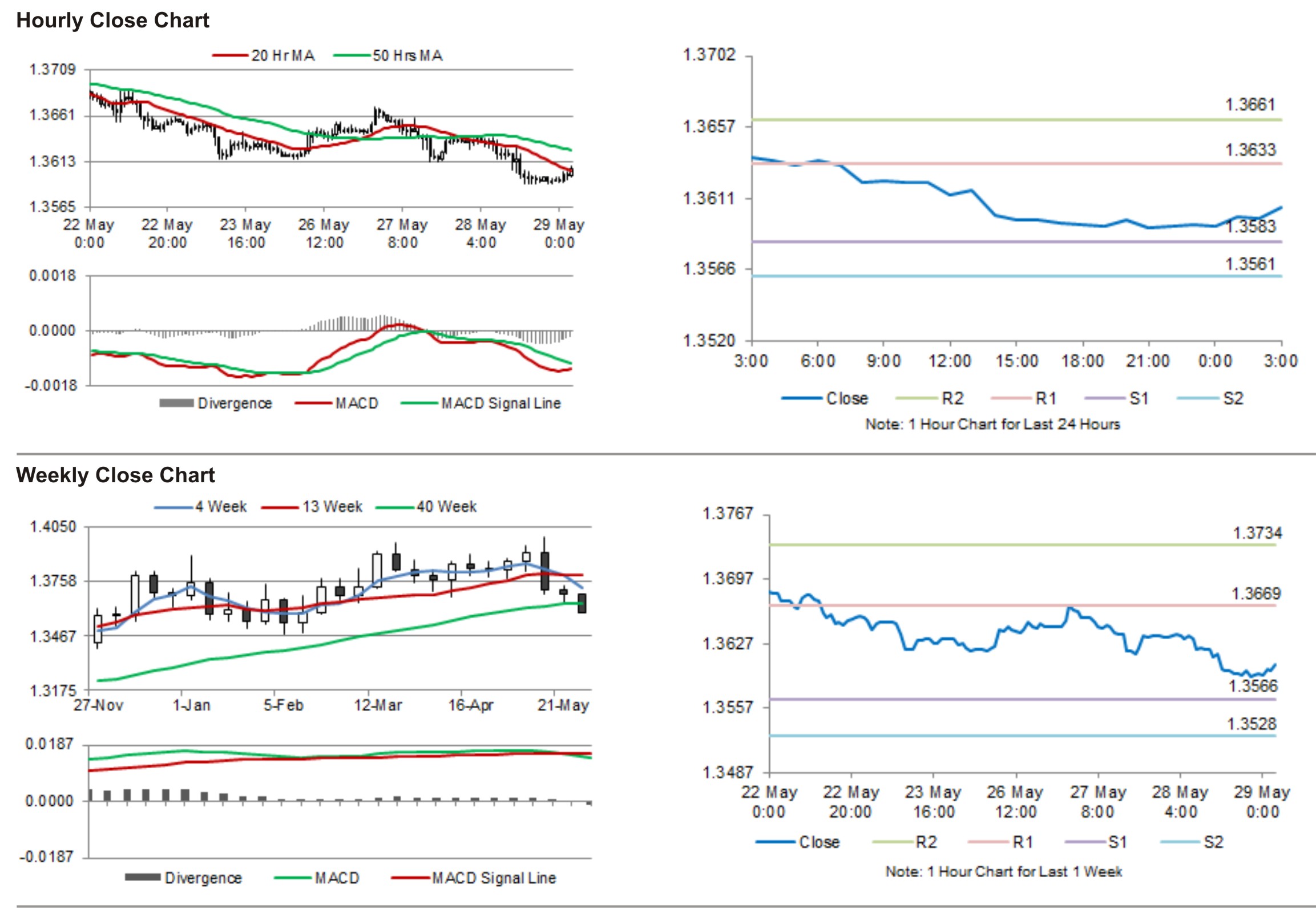

In the Asian session, at GMT0300, the pair is trading at 1.3605, with the EUR trading 0.08% higher from yesterday’s close.

The pair is expected to find support at 1.3583, and a fall through could take it to the next support level of 1.3561. The pair is expected to find its first resistance at 1.3633, and a rise through could take it to the next resistance level of 1.3661.

With no major economic releases from the Euro-zone economy on account of an Ascension Day holiday in most of its major markets, traders would keep an eye on global economic news, along with the US GDP and weekly jobless claims data, for further cues in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.