For the 24 hours to 23:00 GMT, the GBP fell 0.57% against the USD and closed at 1.6714.

In an interview with the Financial Times, a BoE policymaker, Martin Weale opined that the BoE should not delay in raising interest rates, as hiking the rates now would prevent the central bank from painful hikes in the future. Separately, the Confederation of British Industry (CBI) reported that British retail sales grew at a slower pace this month as its monthly distributive trades survey on retail sales balance eased to reading of 16.0 in May from a reading of 30.0 in April.

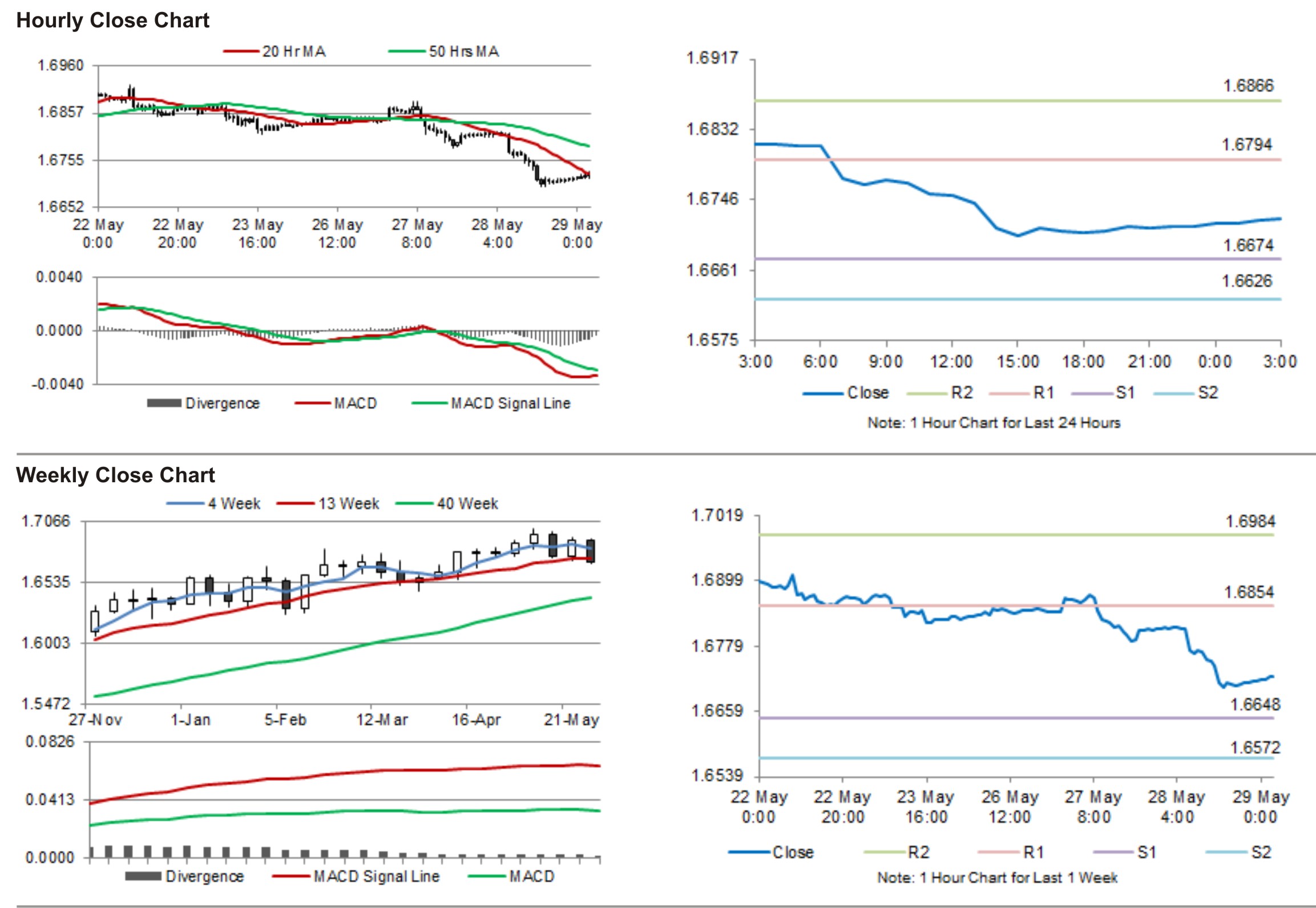

In the Asian session, at GMT0300, the pair is trading at 1.6723, with the GBP trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.6674, and a fall through could take it to the next support level of 1.6626. The pair is expected to find its first resistance at 1.6794, and a rise through could take it to the next resistance level of 1.6866.

Market participants keenly await the release of the UK Gfk consumer confidence data for further guidance in the British Pound.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.