For the 24 hours to 23:00 GMT, USD strengthened 0.83% against the JPY and closed at 81.00, aided by rising risk appetite following news from China and Europe.

The Chinese trade surplus was more than four times larger than forecast for April, surging to $11.4 billion from $140 million a month ago. Risk sentiment was also aided by rumours that the EU had agreed a further aid package for Greece. In the US, the TechnoMetrica Market Intelligence and Investors Business Daily reported that their economic optimism index increased to 42.8 points in May in comparison with 40.8 points registered in April.

In the Asian session at 3:00GMT, the pair is trading lower from the New York close, by 0.15%, at 80.88.

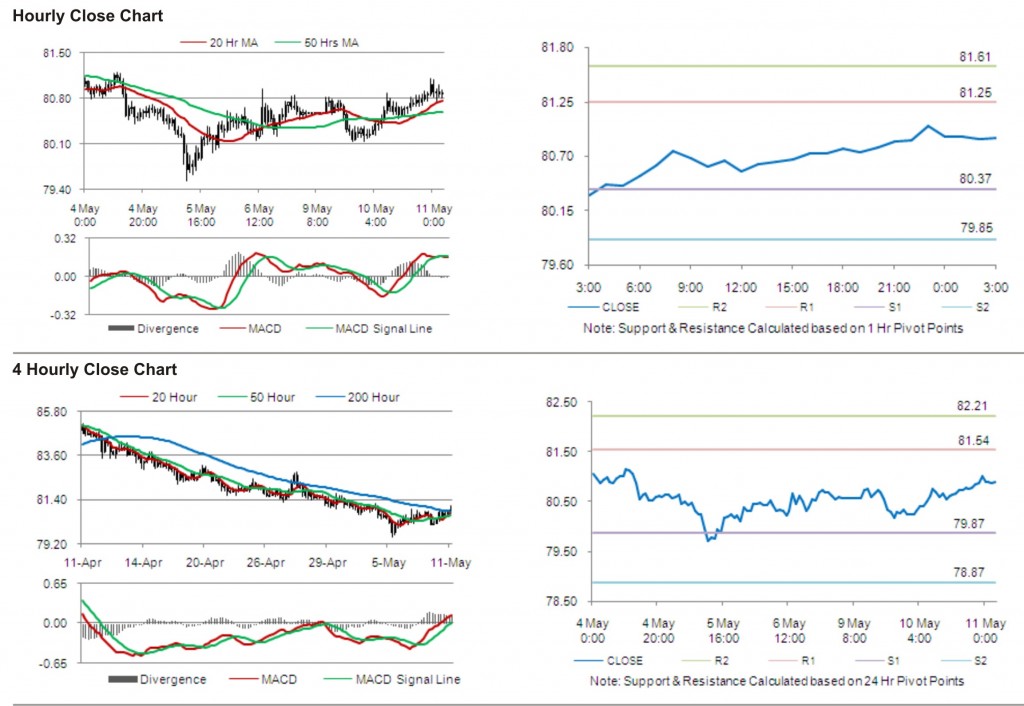

The first short term resistance is at 81.25, followed by 81.61. The pair is expected to find support at 80.37 and the subsequent support level at 79.85.

With a series of Japan economic releases today, including trade balance and money supply, trading in the pair is expected to be influenced by the resulting cues from these releases.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.