For the 24 hours to 23:00 GMT, USD rose 1.00% against the CHF and closed at 0.8799, after Swiss inflation data weighed on expectations that the Swiss National Bank would raise interest rates in the near future.

In the US, the National Federation of Independent Business reported that small business optimism index declined to a reading of 91.2 in April.

In Switzerland, the consumer price index, on a monthly basis, rose by 0.1% in April, compared to a 0.6% increase recorded in the previous month. Additionally, the consumer confidence index in declined to a reading of -1.0 for the quarter ended in April, compared to a reading of 10.0 posted for the quarter ended in January.

In the Asian session, at 3:00GMT, the pair is trading at 0.8801, 0.02% higher from the New York session close.

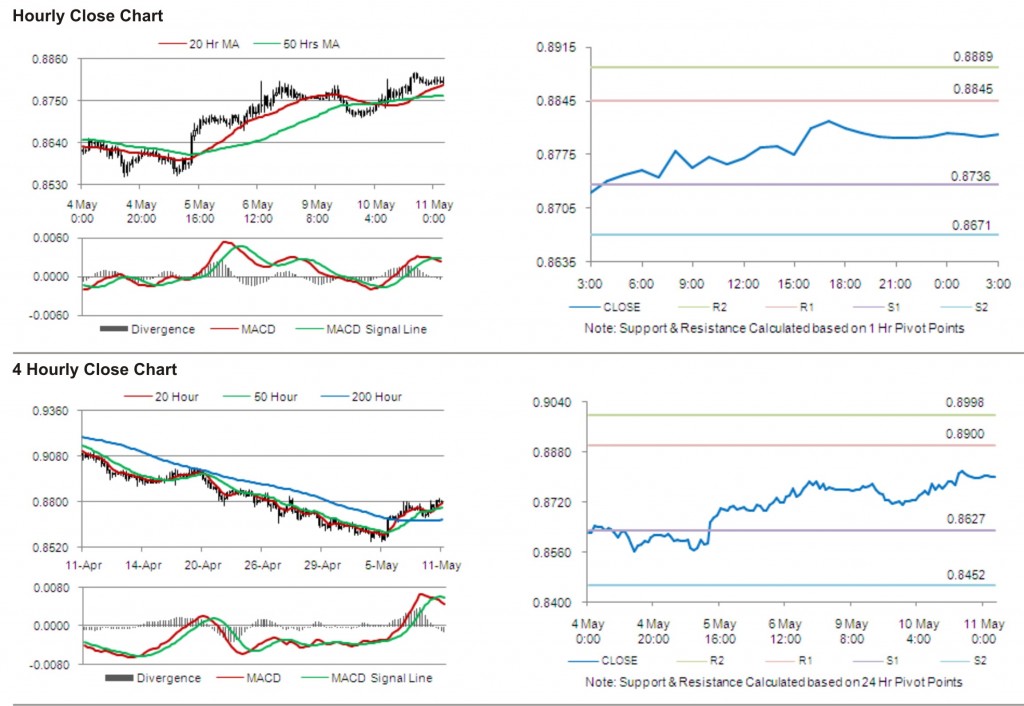

The pair has its first short term resistance at 0.8845, followed by the next resistance at 0.8889. The first area of support is at 0.8736 levels, with the subsequent support at 0.8671.

With no major release from Switzerland, the pair is expected to trade on trends in the greenback.

The currency pair is showing convergence with its 20 Hr moving average and is trading just above its 50 Hr moving average.