For the 24 hours to 23:00 GMT, the USD traded a tad higher against the JPY and closed at 118.94.

In the Asian session, at GMT0400, the pair is trading at 119.32, with the USD trading 0.32% higher from yesterday’s close.

Earlier today, the BoJ kept its key interest rates unchanged at 0.1% and mentioned in its monetary policy statement that the central bank would continue to boost the nation’s monetary base at an annual pace of ¥80 trillion. Meanwhile, the BoJ expressed optimism over the Japanese economy as according to the central bank there was no immediate requirement of stimulus and further indicated that the nation was slowly recovering from the deteriorating effects of April sales-tax hike.

Data just released indicated that Japan’s final leading economic index advanced to a level of 104.5 in October, from previous month’s reading of 104.0 in the previous month. Meanwhile, the nation’s coincident index dropped to 109.9 in October, following a reading of 110.2 recorded in September.

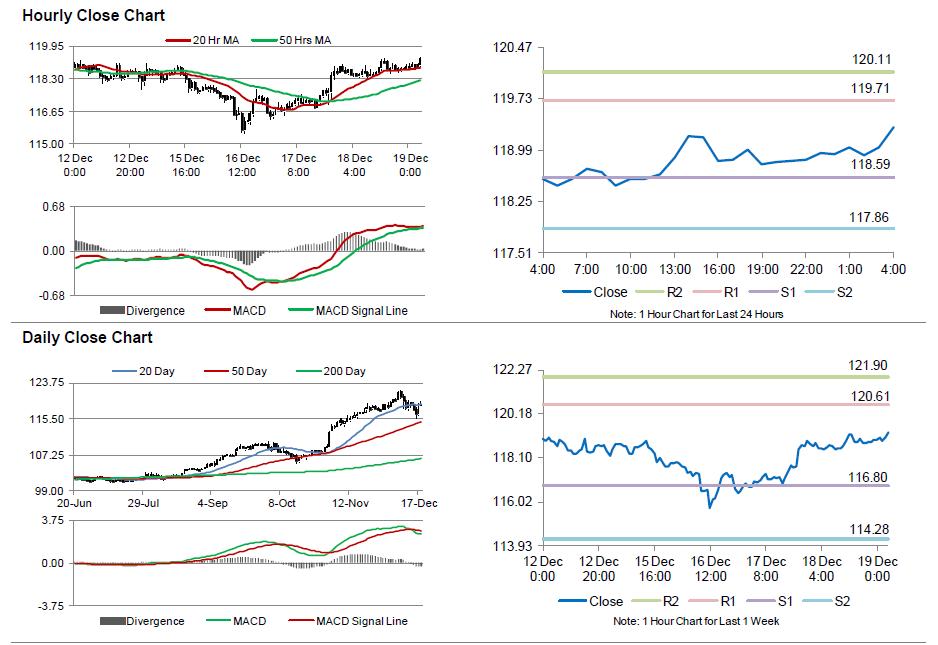

The pair is expected to find support at 118.59, and a fall through could take it to the next support level of 117.86. The pair is expected to find its first resistance at 119.71, and a rise through could take it to the next resistance level of 120.11.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.