For the 24 hours to 23:00 GMT, the USD rose 0.61% against the CHF and closed at 0.9796. The Swiss Franc came under pressure, after the SNB, in an unexpected move, imposed negative interest rate of 0.25% on sight deposit account balances of over 10 million Swiss Francs at the central bank. It further stated that the new rate will be introduced on 22 January 2014, and will only affect banks and large companies who use the “sight account” to transfer funds quickly and without restrictions.

Separately, the SECO kept Switzerland’s 2014 economic growth forecast unchanged at 1.8%, but downgraded the nation’s economic growth estimation for 2015 to 2.1% from 2.4%. It also projected a dismal outlook for the nation’s inflation growth in the coming year.

In other economic news, Swiss trade surplus expanded to CHF 3.87 billion in November, following a revised trade surplus of CHF 3.23 billion in the prior month, while market expectations were for it to narrow to CHF 2.92 billion. On the other hand, exports as well as imports retreated on a monthly basis in November.

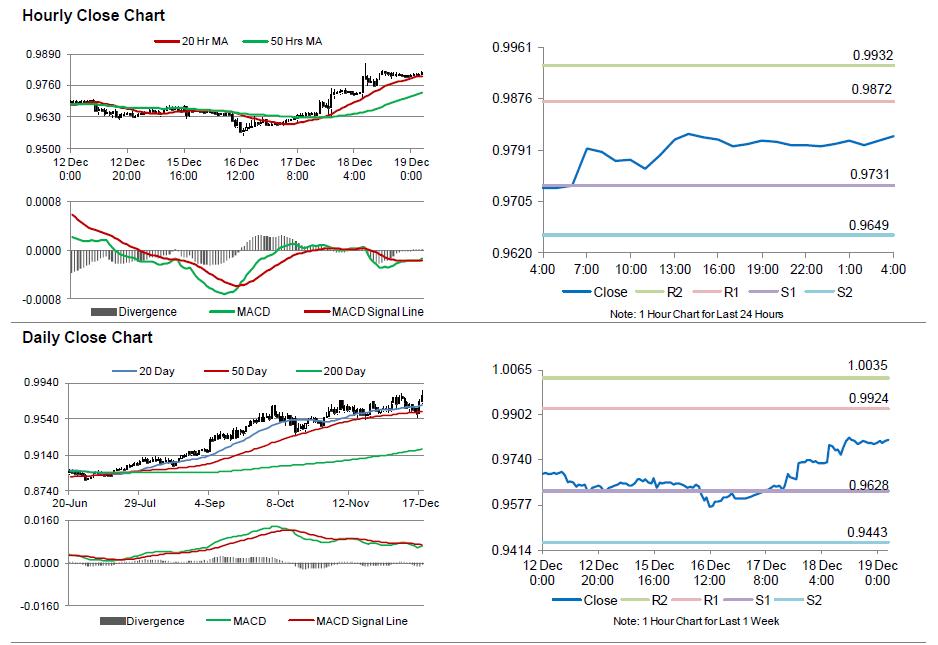

In the Asian session, at GMT0400, the pair is trading at 0.9813, with the USD trading 0.17% higher from yesterday’s close.

The pair is expected to find support at 0.9731, and a fall through could take it to the next support level of 0.9649. The pair is expected to find its first resistance at 0.9872, and a rise through could take it to the next resistance level of 0.9932.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.