For the 24 hours to 23:00 GMT, the GBP fell 0.28% against the USD and closed at 1.5310, after UK’s weak construction and manufacturing sector activity slowed down the nation’s economy in the 3Q of 2015.

The flash UK GDP growth advanced 0.5% QoQ in 3Q 2015, less than market expectations for an advance of 0.6%. The nation’s GDP had climbed 0.7% in the previous quarter. On a YoY basis, the economy grew 2.3% during the same period, recording its lowest rate of growth since the third quarter of 2013, and compared to an advance of 2.4% in the previous quarter. Markets were anticipating it to remain steady.

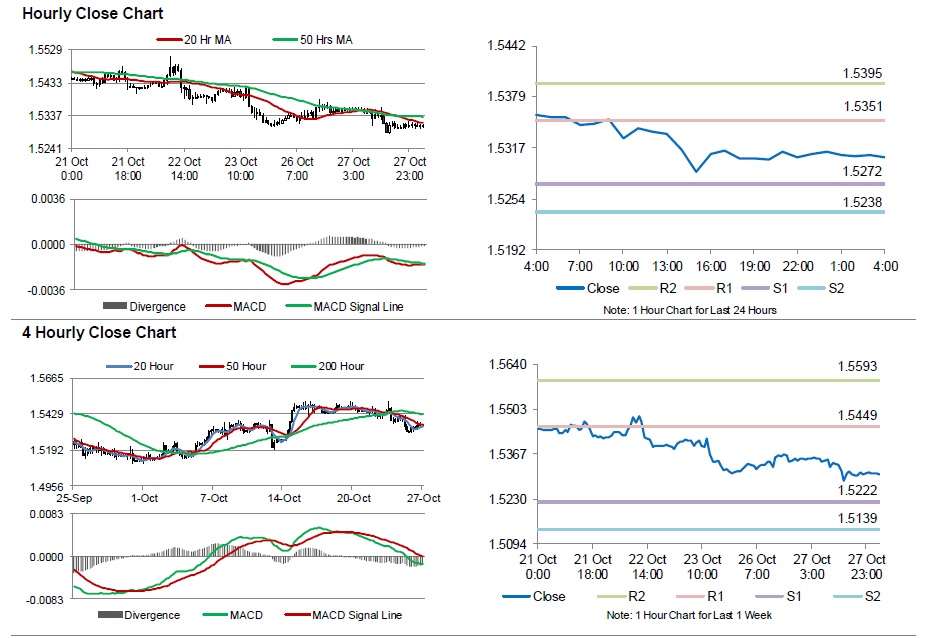

In the Asian session, at GMT0400, the pair is trading at 1.5306, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.5272, and a fall through could take it to the next support level of 1.5238. The pair is expected to find its first resistance at 1.5351, and a rise through could take it to the next resistance level of 1.5395.

Moving ahead, market participants will look forward to UK’s consumer credit and mortgage approvals data, both for the month of September, scheduled to be released tomorrow.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.