For the 24 hours to 23:00 GMT, the USD weakened 0.54% against the JPY and closed at 120.40.

In the Asian session, at GMT0400, the pair is trading at 120.35, with the USD trading marginally lower from yesterday’s close.

Overnight data showed that Japan’s large retailer’s sales rose more-than-expected by 1.7% in September, after registering a 1.8% increase in the previous month. Investors had expected it to rise 1.4%. On the other hand, the nation’s retail trade climbed 0.7% MoM in September, lower than market expectations for a rise of 1.1%, and after recording a flat reading in the prior month.

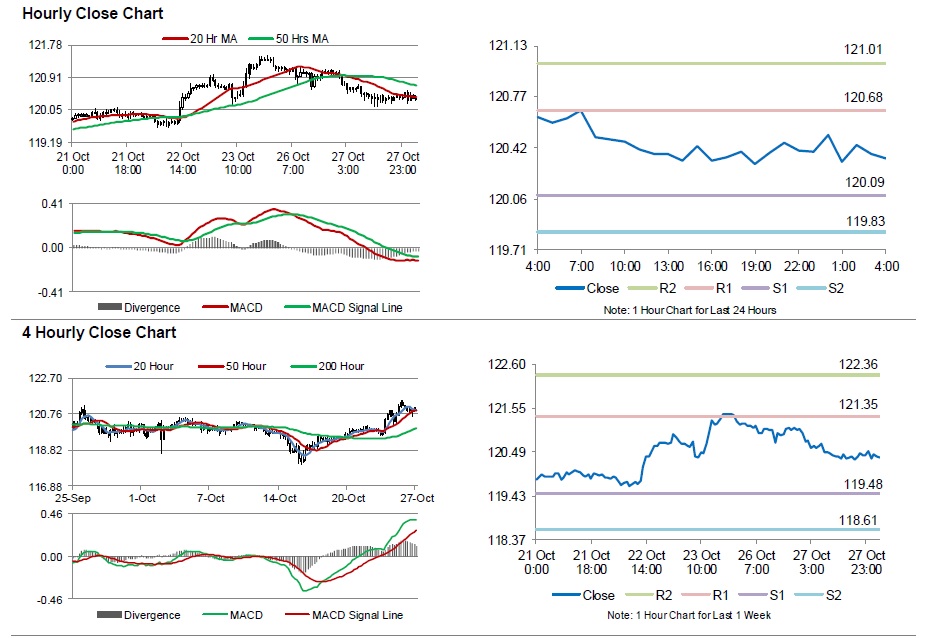

The pair is expected to find support at 120.09, and a fall through could take it to the next support level of 119.83. The pair is expected to find its first resistance at 120.68, and a rise through could take it to the next resistance level of 121.01.

Going ahead, market participants will await Japan’s industrial production data for September, scheduled to be released overnight, for further cues.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.