For the 24 hours to 23:00 GMT, the GBP rose 0.14% against the USD and closed at 1.4187, after the release of mixed UK labour data.

Data showed that UK’s ILO unemployment rate unexpectedly fell to the lowest level in almost a decade, after it declined to 5.1% in November, compared to market expectations for it to remain steady at 5.2%. Additionally, the nation’s average weekly earnings for 3 months rose less than expected by 2.0% in three month period ended in November, recording its lowest growth rate since February 2015. Meanwhile markets anticipated it to rise by 2.1%, compared to previous month’s gain of 2.4%.

On the other hand, the number of people employed advanced more than expected to a level of 267K in the same period while markets expected it to rise to a level of 235K, compared to previous month’s reading of 207K.

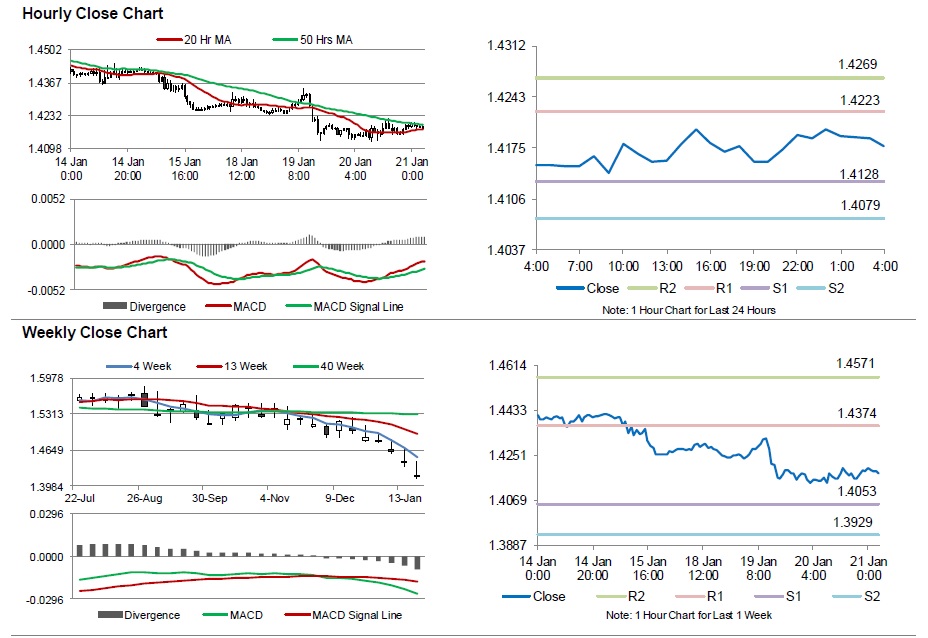

In the Asian session, at GMT0400, the pair is trading at 1.4177, with the GBP trading 0.07% lower from yesterday’s close.

Early this morning, data showed that UK’s RICS house price balance advanced to a level of 50.0 in December, from 49.0 in the previous month. Markets were expecting house price balance to rise to a level of 50.0.

The pair is expected to find support at 1.4128, and a fall through could take it to the next support level of 1.4079. The pair is expected to find its first resistance at 1.4223, and a rise through could take it to the next resistance level of 1.4269.

The currency pair is trading between its 20 Hr and 50 Hr moving averages.