For the 24 hours to 23:00 GMT, the EUR declined 0.2% against the USD and closed at 1.0889, after Germany’s producer price index declined more than expected by 0.5% on a monthly basis in December, following previous month’s drop of 0.2% while markets expected it to fall by 0.4%.

In the US, the consumer price index unexpectedly declined by 0.1% MoM in December while market expected it to remain flat in accordance with previous month’s reading, thus offering signs of weak inflation in the country. Additionally, the nation’s housing starts unexpectedly fell 2.5% MoM in December, compared to investor expectations of a rise of 2.5% and following a revised gain of 10.1% in the preceding month. Meanwhile, the nation’s building permits declined less than expected by 3.9% MoM in December, from a revised gain of 10.4% in the preceding month and compared to market expectations of a drop of 6.4%, thus dampening investor sentiment over the health of the US housing sector. On the other hand, US MBA mortgage application rose by 9% in the week ended January 15, after previous month’s increase of 21.3%.

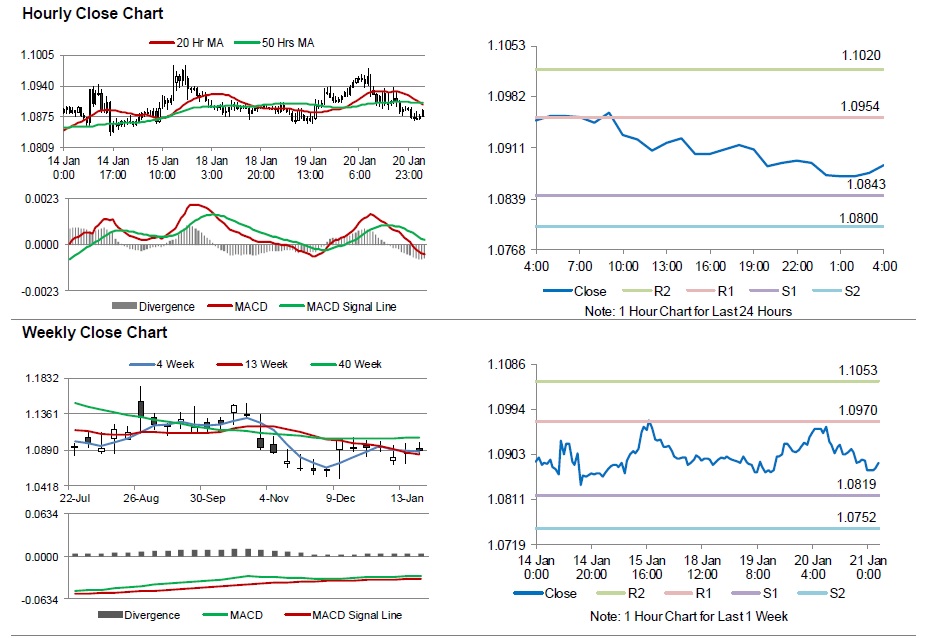

In the Asian session, at GMT0400, the pair is trading at 1.0887, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0843, and a fall through could take it to the next support level of 1.08. The pair is expected to find its first resistance at 1.0954, and a rise through could take it to the next resistance level of 1.102.

Going ahead, investors will look forward to ECB’s interest rate decision, due later in the day. Additionally, the US initial jobless claims data, scheduled later in the day would also grab market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.