For the 24 hours to 23:00 GMT, the EUR rose 0.81% against the USD and closed at 1.1289.

In economic news, the Euro-zone’s private sector loans rose by 1.6% YoY in February, its fastest rate since 2011, after registering a 1.4% rise in the previous month.

Separately, the ECB’s Governing Council member, Jozef Makuch, stressed that interest rate cut as a policy tool has almost exhausted and that further reductions will have less effect on the economy. He also mentioned that the central bank will ease monetary policy further, if necessary.

The greenback lost ground, after the Federal Reserve Chair, Janet Yellen, reiterated the need for the central bank to “proceed cautiously” with future interest rate hikes, given the backdrop of unfavourable market conditions, weaker-than-expected overseas growth and plunging oil prices. Further, she acknowledged that it is ‘too early’ to state if a pickup in core inflation will prove durable.

In other economic news, the US consumer confidence index surprisingly advanced to a level of 96.2 in March, compared to investor expectations for it to remain steady at a level of 94.0. Moreover, the nation’s S&P/Case-Shiller composite home price index (HPI) of 20 metropolitan areas advance more-than-expected by 5.75% YoY in January, compared to a revised advance of 5.65% in the previous month. Market anticipation was for the index to advance by 5.73%.

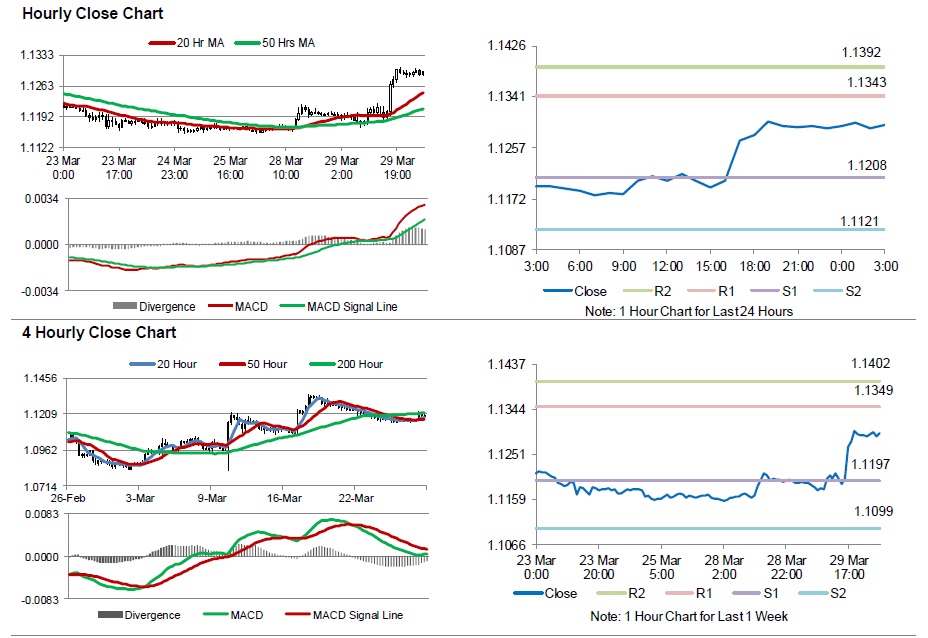

In the Asian session, at GMT0300, the pair is trading at 1.1295, with the EUR trading marginally higher from yesterday’s close.

The pair is expected to find support at 1.1208, and a fall through could take it to the next support level of 1.1121. The pair is expected to find its first resistance at 1.1343, and a rise through could take it to the next resistance level of 1.1392.

Moving ahead, investors will look forward to Germany’s consumer price index data for March, scheduled to release later today. Additionally, the US ADP employment change data for March, due later in the day, will also attract market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving average.