For the 24 hours to 23:00 GMT, the GBP rose 0.90% against the USD and closed at 1.4385.

Yesterday, the BoE’s financial policy committee, echoed recent remarks by the central bank Governor, Mark Carney, that the referendum on Britain’s membership in the European Union represented “the most significant near-term domestic risks to financial stability”. The central bank also warned that prolonged uncertainty over UK’s referendum on its membership in the European Union could lead to a further depreciation of the pound

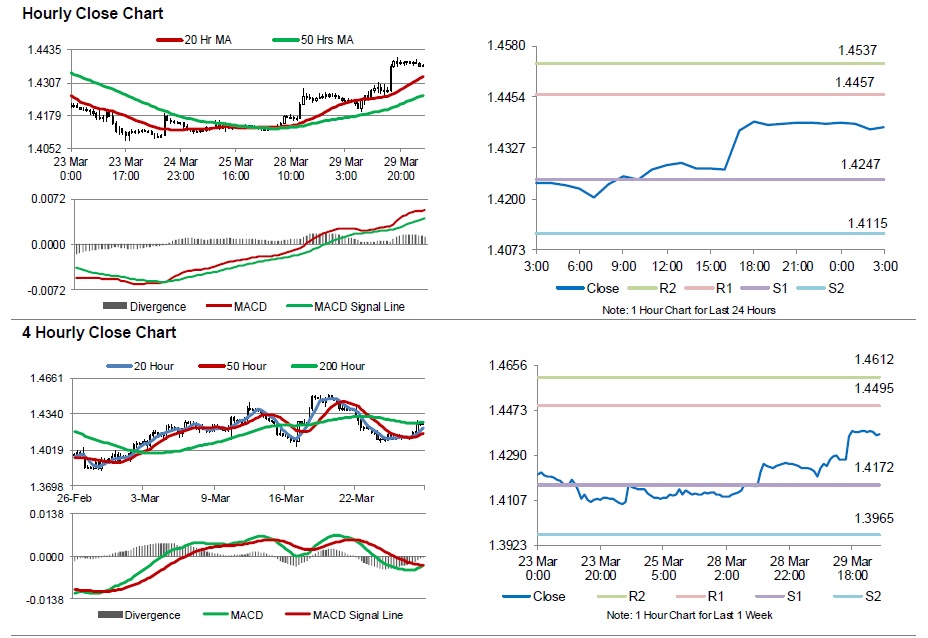

In the Asian session, at GMT0300, the pair is trading at 1.4378, with the GBP trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.4247, and a fall through could take it to the next support level of 1.4115. The pair is expected to find its first resistance at 1.4457, and a rise through could take it to the next resistance level of 1.4537.

Moving ahead, investors will look forward to UK’s Gfk consumer confidence index for March, scheduled to release overnight.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.